The first quarter of 2025 reaffirmed Bitcoin’s pivotal role as the bellwether of the cryptocurrency market. As the leading digital asset, Bitcoin continues to shape sentiment, liquidity, and momentum across the broader ecosystem—including altcoins such as Telcoin. The quarter began with a historic milestone, as Bitcoin surged to a new all-time high of approximately $109,000 in January, driven by accelerating institutional interest and expanding regulatory clarity. This momentum underscored Bitcoin’s influence in setting the tone for the entire crypto market, with altcoins often mirroring its trajectory.

However, macroeconomic pressures and profit-taking activities prompted a pullback later in the quarter, reaffirming Bitcoin's outsized impact on market volatility and risk appetite. Despite this, institutional investment deepened, supported by maturing infrastructure and more transparent policy frameworks. These developments reinforced Bitcoin's status as a digital asset and a foundational driver of market trends—particularly relevant to emerging platforms like Telcoin, which rely on overall ecosystem growth and investor confidence.

This report distills the key developments of Q1 2025 across institutional adoption, regulatory evolution, infrastructure expansion, and market sentiment. We also offer a forward-looking perspective on what to expect in Q2 2025.

Institutional Adoption Trends

Broadening Institutional Exposure:

Institutions worldwide accelerated their Bitcoin adoption in early 2025. A Coinbase/EY-Parthenon survey of 352 institutional investors found that 83% plan to increase crypto allocations in 2025, with 59% intending to allocate over 5% of AUM to digital assets. This marks crypto's evolution from a niche bet to a core portfolio asset. Major asset managers launched or expanded Bitcoin products – notably BlackRock's iShares Bitcoin Trust (IBIT), which amassed $50+ billion AUM by late 2024 and continued growing in Q1, reflecting strong demand.

Sovereign and Corporate Adoption:

Not only private funds, but government and corporate treasuries grew more comfortable with Bitcoin. The United States signaled unprecedented support by establishing a Strategic Bitcoin Reserve via executive order in March, consolidating seized BTC into national reserves. A director at S&P Global described it as "the first time Bitcoin is formally recognized as a reserve asset by the U.S. government". This legitimization encourages other institutions like pension funds and endowments to follow suit. Outside the U.S., sovereign investors also increased exposure: the Czech National Bank approved Bitcoin for its reserves, and Norway’s sovereign wealth fund boosted its BTC holdings by 150% year-on-year to over $350 million. In the corporate arena, fintech and TradFi firms stepped up crypto engagement – for example, market-maker Citadel started evaluating Bitcoin liquidity provision, and BlackRock and Robinhood advanced asset tokenization projects. Regulatory changes (discussed below), like updated accounting rules (e.g., the repeal of SAB 121), now allow U.S. banks to hold digital assets on balance sheets, further opening the door for corporate treasury allocations.

Spotlight on Bitcoin ETFs:

A major channel for institutional flow has been Bitcoin exchange-traded funds (ETFs). Bitcoin ETF net inflows were substantial in late 2024 (e.g. +$6.47B in Oct 2024) and remained positive in January 2025. However, February saw a sharp reversal with a record $3.54B monthly net outflowfrom Bitcoin ETFs. This outflow – the largest since ETFs launched – underscores that some institutions took Q1 profits or turned cautious amid volatility.

Global Regulatory Developments

United States:

Q1 2025 marked a regulatory pivot in the U.S. under a new administration. In his first week, President Trump issued an executive order promoting crypto innovation, and by March, the administration had created the Strategic Bitcoin Reserve, as noted. The SEC's leadership saw turnover and a more crypto-friendly stance – the SEC dropped high-profile lawsuits against exchanges like Coinbase and Gemini, while pro-innovation officials were appointed across agencies (SEC, CFTC, OCC, FDIC). In an official bulletin on March 7, 2025, the OCC confirmed that U.S. banks can legally offer digital asset custody, use distributed ledgers, and transact with stablecoins – a major green light for bank involvement. Meanwhile, Congress took up landmark legislation: a bipartisan stablecoin bill (with full reserve and audit requirements) gained momentum, and a broader market structure bill defining digital asset taxonomy was introduced. These efforts – priorities for the administration – aim to pass by summer 2025, potentially unlocking further institutional confidence.

Europe:

In the EU, the long-anticipated MiCA (Markets in Crypto-Assets) regulation was formally adopted, paving the way for uniform rules for crypto service providers across member states. MiCA’s implementation (set to phase in starting mid-2025) is expected to reduce regulatory fragmentation. Still, analysts note Europe's institutional Bitcoin adoption has lagged behind the U.S., partly due to fragmented national rules and shallower liquidity pools. The UK similarly faces challenges; industry commentators argue the UK's regulatory structure – including the Financial Conduct Authority's classification approach – has been a barrier to institutional crypto uptake (leading some to call the UK a laggard as of March 2025). On a positive note, Switzerland and other European jurisdictions with clear crypto frameworks continued to attract institutional businesses such as crypto banks and exchange-traded products.

Asia-Pacific and Middle East:

Asia’s regulatory stance diversified. Hong Kong enacted a new licensing regime that by Q1 allowed retail trading of crypto under approved exchanges – a pro-adoption move positioning Hong Kong as a regional crypto hub (to draw global institutions, including Chinese state-affiliated funds, into crypto markets through a regulated channel). Singapore and Japan maintained their steady, innovation-friendly regulatory environments, with Japan exploring CBDC pilots and Singapore refining its stablecoin guidelines. The UAE established a dedicated federal agency for digital asset oversight in the Middle East, complementing Dubai's existing VARA to supervise the sector. Along with Qatar's and Saudi Arabia's early-stage blockchain initiatives, these steps indicate a trend of jurisdictions vying for institutional crypto business by crafting crypto-friendly regulations.

Below is a summary of key regulatory actions in Q1 by region:

Infrastructure and Ecosystem Development

Spot ETFs and Investment Vehicles:

The launch of U.S. spot Bitcoin ETFs in late 2024 catalyzed institutional access. By Q1 2025, these vehicles saw heavy usage, with one fundraising over $50B within months. While February saw outflows, regulated Bitcoin ETFs on major exchanges (including in the U.S., Canada, and Europe) significantly lowered barriers for institutional investors. Additionally, other investment products gained traction: Bitcoin ETPs in Europe (such as Germany and Switzerland) continued to grow, and futures-based ETFs in Asia (e.g., Singapore) provided alternatives where spot products were pending approval.

Custody and Banking Infrastructure:

A critical piece for institutions is secure custody. Q1 brought improved custodial frameworks. In the U.S., as noted, regulators explicitly allowed banks to custody crypto. They signaled more accommodative capital treatment for digital assets (revisiting stringent rules that previously discouraged banks from holding crypto assets on balance sheets). Major custodians like BNY Mellon and Fidelity Digital Assets reported increased institutional client onboarding. Furthermore, the industry saw growth in insurance solutions for digital asset custody (to mitigate risks of hacks), a necessary service given Q1's unfortunate distinction as the worst quarter ever for crypto hacks ($1.64B lost to exploits). Despite security incidents, the establishment of robust custodial standards and audit requirements (through pending legislation and industry consortia) is strengthening institutional confidence.

Stablecoins and Tokenization:

Stablecoins form a critical bridge for institutional crypto activity. In the past year up to Q1 2025, stablecoin transaction volume topped $33 trillion, over 2.5× Visa’s annual volume – highlighting how integral stablecoins have become for liquidity and payments. Q1 saw sustained stablecoin inflows, about $9.9B net into crypto markets in January alone, which helped support Bitcoin’s rally to new highs. Institutions increasingly utilize stablecoins for settlement, forex, and yield (per the Coinbase survey, 84% of investors are using or interested in using stablecoins ). Infrastructure to support this – from stablecoin custody by banks to on-chain treasury management tools – expanded in Q1. Additionally, real-world asset tokenization picked up pace (e.g., bonds and real estate tokens on blockchain), often using Bitcoin or Ethereum networks; this wider tokenization trend is gradually folding Bitcoin into traditional financial workflows (for instance, using Bitcoin as collateral in DeFi or receiving tokenized cash flows in BTC).

Market Sentiment and Investment Flows

Sentiment Rollercoaster:

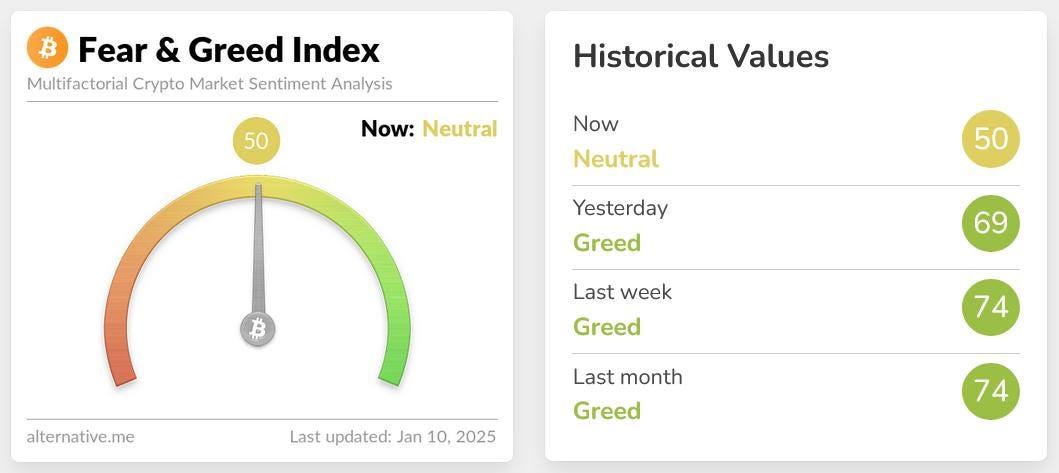

Market sentiment oscillated dramatically through the quarter. January began in a state of optimism – the crypto Fear & Greed Index entered the “Greed” zone, climbing above 70 mid-month amid Bitcoin’s surge. The ETF-driven rally and anticipation of favorable U.S. policies fueled this bullish sentiment. However, sentiment flipped to extreme fear by late February as Bitcoin's price plunged from its highs. On February 27, the Fear & Greed Index hit 10 ("Extreme Fear"), a multi-year low, as BTC briefly dipped below $86,000. Contributing factors included macro uncertainty(e.g. new U.S.–China trade tariffs announced, which rattled risk assets), crypto-specific turmoil (the unwinding of a meme-coin frenzy that had drained liquidity), and major security incidents (like a $1.4B exchange hack) that hurt confidence.

Investment Flows:

Despite interim fear, institutional flows overall remained net positive for Q1. Large U.S. Bitcoin treasuries (such as ETFs and trust funds) saw inflows in January that outweighed February outflows, and on-chain data indicated continued accumulation by long-term institutional holders (e.g., addresses associated with OTC desks). Crypto fund flow data showed that Q1 2025 had more weekly inflows than outflows for Bitcoin-focused funds, although the pace slowed relative to late 2024. Notably, a rotation occurred where some capital moved from altcoins into Bitcoin ("flight to quality") – Bitcoin's market dominance crept upward as multi-asset crypto funds rebalanced toward BTC, especially after high-profile altcoin setbacks. For instance, the collapse of a hyped LIBRA token in February sparked risk-off behavior that benefited Bitcoin's relative standing.

Market Performance:

Bitcoin's price ended Q1 around the mid-$80,000s, roughly 5–10% below its January opening price (still up significantly year-over-year). This modest quarterly decline of ~7% belies the intra-quarter volatility: a new all-time high was set in January (just over $100k) before a retracement. The broader crypto market cap fell ~19% in Q1 amid sharp altcoin corrections – indicating Bitcoin outperformed most other crypto assets during this risk-off shift. Investment flows by region showed North American and Middle Eastern investors largely buying dips (especially sovereign funds and crypto ETFs in those regions), whereas some European funds trimmed exposure, citing internal mandates on risk. The table below highlights Q1 institutional investment flow indicators:

Q2 2025 Outlook

Macro Expectations:

Q2 2025 is poised to test whether Bitcoin's bull thesis holds amid evolving macro conditions. Many analysts anticipate that global central banks may start easing monetary policy by mid-2025 if inflation cools – a potential tailwind for Bitcoin if liquidity conditions improve. The U.S. Fed's tone in Q2 (pause vs. hike) will be pivotal; any hint at rate cuts could renew risk-on appetite. Conversely, persistent inflation or economic shocks (e.g., an escalation in geopolitical tensions or higher energy prices) could delay a crypto market rebound. Investors will also watch equity correlations – Bitcoin's correlation with tech stocks spiked during Q1's turmoil, so any stabilization in equities could bolster crypto sentiment.

Regulatory Events to Watch:

The second quarter will likely clarify the regulatory environment shaped in Q1. In the U.S., the crypto industry is optimistic about progress on the stablecoin bill and possibly the passage of a digital asset market structure law. The SEC's stance on pending Bitcoin ETF applications (for additional products or Ethereum spot ETFs) is another focal point; a more accommodative SEC could approve new offerings by summer. In Europe, Q2 may see final technical standards issued under MiCA and the preliminary framework for a digital Euro. Asia’s developments include Hong Kong’s first licensed exchanges going live for retail (testing whether new money flows in) and perhaps movement in India (which has been deliberating a CBDC and crypto regulations). Overall, the regulatory momentum from Q1 is expected to continue reducing uncertainty – a key catalyst cited by 83% of institutions as needed for further crypto investment.

Market Sentiment and Trend:

Entering Q2, market sentiment is cautious but not bearish. The extreme fear of late February subsided after Bitcoin found support around $80k, and by early April, the Fear & Greed Index had edged back into the neutral 40–50 range. Q2 likely begins in consolidation: Bitcoin could trade in a range as the market digests Q1's rapid swings. A consolidation phase around current levels (~$85k ± 10%) might be healthy, allowing for re-accumulation. Some analysts, such as those at VanEck, predicted a medium-term peak in Q1 followed by a correction, then new highs by late 2025. This scenario suggests that Q2 could be choppy or sideways before an eventual uptrend resumes in the second half. In the interim, institutional inflows may resume gradually – for example, if macro conditions stabilize, Q2 could see fresh allocations into Bitcoin from those institutions that sat out the volatility.

Key Catalysts in Q2:

Potential positive catalysts include macro easing (rate cuts), corporate Bitcoin announcements (e.g. a Fortune 500 company adding BTC to its treasury or a major payment network integrating Bitcoin), and tech catalysts (such as breakthroughs in Bitcoin’s scalability or notable Lightning Network integrations). On the other hand, investors remain vigilant for risks such as regulatory setbacks (if, say, legislation stalls or a new enforcement action surprises the market) and market technicals (Bitcoin needs to hold key support levels to avoid a deeper correction).

Bottom line

Overall, Q1 2025 reinforced Bitcoin’s growing stature among institutions, even as markets underwent a healthy correction. Global regulatory progress and infrastructure maturation provided a stronger foundation for long-term adoption. With many institutional investors viewing crypto as a strategic asset class, the stage is set for Q2 to build on these developments. A cautious optimism prevails: stakeholders expect clearer rules and favorable macro trends in the coming quarter, which will translate into renewed investment momentum and continued integration of Bitcoin into traditional finance.

Disclaimer

The information and content (collectively 'information') provided herein are general information. The authors do not guarantee the suitability or potential value of any information or particular investment source. Any information herein is not intended, nor does it constitute financial, tax, legal, investment, or other advice. The authors have no affiliation with Telcoin or other persons or companies referred to in this article. The information in this article is based on the sources used.