The Genius of Telcoin and the GENIUS Act: How Telcoin is Miles Ahead in Stablecoin Issuance

Vol 4(3)

Introduction

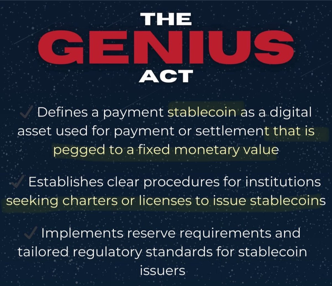

The financial landscape is rapidly evolving, with stablecoins emerging as a bridge between traditional banking and decentralized finance. The recent passage of the GENIUS Act by the U.S. Senate Banking Committee represents a significant step towards regulating stablecoin issuance, ensuring compliance with federal and state financial standards. The Act establishes strict licensing and operational requirements, prohibiting any entity that does not meet these standards from issuing stablecoins in the U.S. This sweeping regulation is set to redefine the stablecoin ecosystem by enforcing transparency, consumer protections, and financial stability.

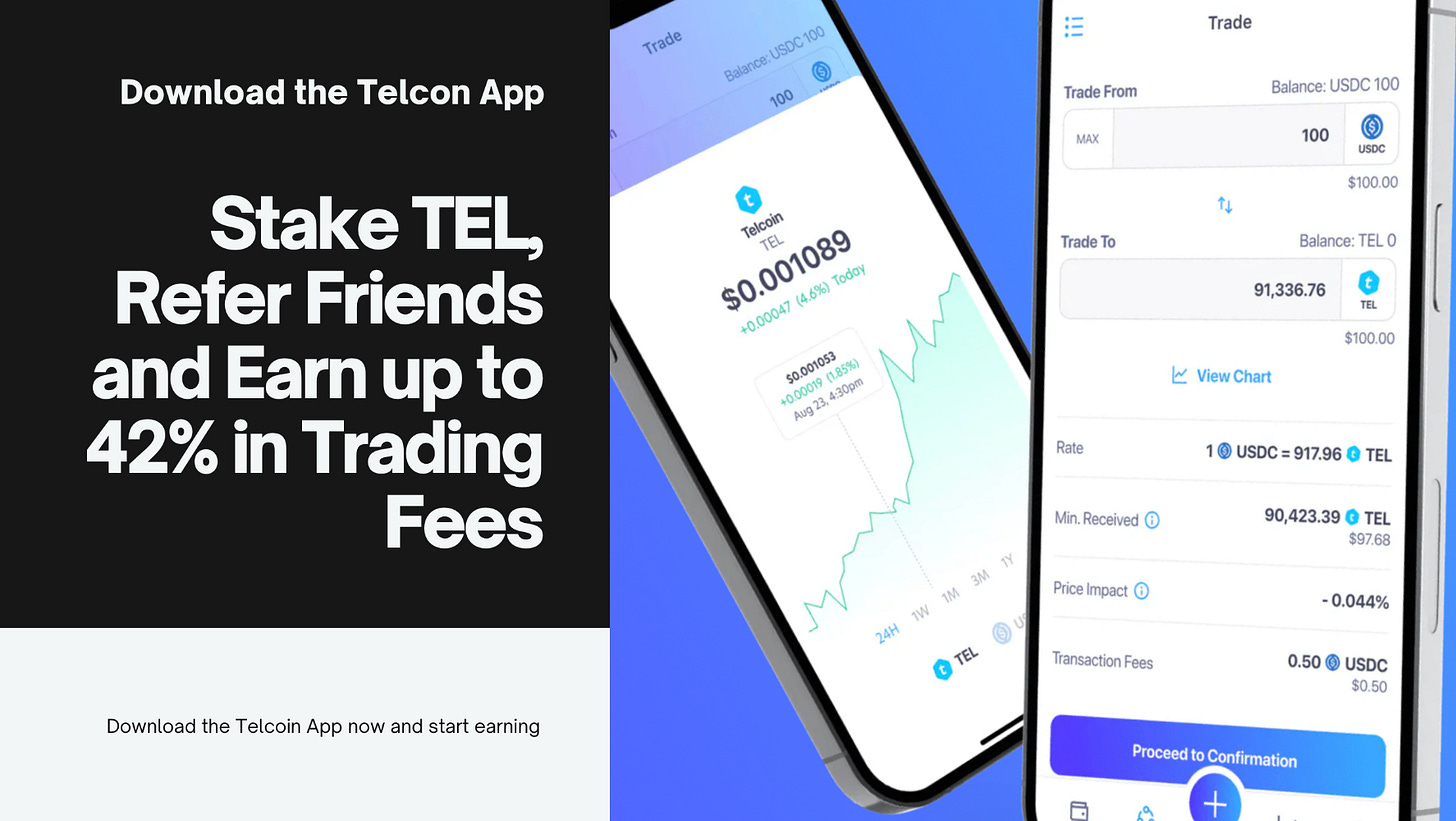

Amid these regulatory shifts, Telcoin has positioned itself at the forefront of compliance and innovation. With its recent conditional approval from Nebraska's Department of Banking and Finance for a Digital Asset Depository Charter, Telcoin is among the few entities that meet the rigorous requirements outlined in the GENIUS Act. This approval enables Telcoin to issue stablecoins and hold digital asset deposits, ensuring it remains a key player as the regulatory landscape tightens. As the GENIUS Act reshapes the stablecoin market by excluding non-compliant issuers, Telcoin’s proactive approach under Nebraska’s progressive financial regulations places it in a strong leadership position. This article explores the key provisions of the GENIUS Act, its correspondence with the Nebraska Financial Innovation Act, and how Telcoin already meets the requirements set forth by this landmark legislation.

Key Provisions of the GENIUS Act

The GENIUS Act establishes a robust regulatory framework for stablecoin issuance in the United States. The Act mandates that only permitted payment stablecoin issuers can issue stablecoins, thereby ensuring that issuers meet strict financial and operational standards. These issuers must fall into one of three categories:

Subsidiaries of insured depository institutions,

Federally qualified nonbank stablecoin issuers,

State-qualified issuers operating under federal or substantially similar state regulations.

Furthermore, the Act defines a payment stablecoin as a digital asset fully backed by fiat currency or other secure reserves, ensuring a 1:1 ratio to prevent price instability. Issuers are required to maintain segregated reserves, adhere to monthly certification requirements, and follow strict capital and liquidity requirements. Additionally, the Act grants federal banking agencies enforcement authority over stablecoin issuers, providing mechanisms for regulatory supervision and compliance. Importantly, it also provides protections for stablecoin custodians, ensuring customer funds remain separate from corporate assets and are not classified as liabilities.

Correspondence with the Nebraska Financial Innovation Act

The GENIUS Act closely aligns with the Nebraska Financial Innovation Act, which was spearheaded by Senator Mike Flood and Telcoin CEO Paul Neuner and paved the way for innovative financial institutions such as Telcoin to integrate digital assets within a regulated framework. Nebraska’s law enables the establishment of digital asset depository institutions, allowing them to issue stablecoins and provide custody services while ensuring compliance with state and federal regulations. Telcoin’s recent approval under this framework demonstrates the practical implementation of these principles.

Like the GENIUS Act, the Nebraska Financial Innovation Act enforces strict reserve requirements, ensuring stablecoins are fully backed by fiat assets. It also mandates segregation of reserves, prohibits rehypothecation, and requires regular audits to guarantee transparency. Furthermore, the Act allows Nebraska’s regulatory authorities to collaborate with federal agencies, ensuring that state-approved issuers align with national financial stability standards. By operating within this regulatory framework, Telcoin has already achieved compliance with most of the GENIUS Act’s provisions, making it a model for stablecoin issuance under the emerging national regulatory regime.

Telcoin’s Compliance with the GENIUS Act

Telcoin’s recent approval for a Digital Asset Depository Charter under Nebraska’s financial innovation regulations positions it as a compliant and forward-thinking stablecoin issuer. The GENIUS Act requires stablecoin issuers to meet strict reserve, segregation, and auditing standards, all of which Telcoin has proactively addressed.

Regulated Issuer Status: Under the Nebraska framework, Telcoin qualifies as a state-approved digital asset depository, ensuring its operations comply with both state and federal regulations. Since the GENIUS Act allows for state-qualified issuers under substantially similar standards, Telcoin is well within compliance.

Full Reserve Backing: Telcoin adheres to the 1:1 backing requirement, ensuring that every issued stablecoin is fully collateralized with fiat reserves or other high-quality liquid assets, in line with the GENIUS Act’s requirements.

Segregation of Reserves: The GENIUS Act mandates that stablecoin reserves be segregated from operational funds to prevent commingling and potential misuse. Telcoin follows this practice, ensuring that customer funds remain protected and transparent.

Regular Auditing and Transparency: Telcoin’s operational framework includes regular third-party audits and financial disclosures, a requirement that the GENIUS Act enforces on all stablecoin issuers. This transparency ensures trust and regulatory compliance.

Consumer Protection and Cybersecurity: The GENIUS Act imposes stringent consumer protection measures, including segregation of custodial assets and enhanced cybersecurity. Telcoin has already implemented industry-leading security measures to protect digital asset holdings, making it a model for safe and compliant stablecoin operations.

Bottom line

The GENIUS Act represents a crucial step toward establishing a stable and reliable regulatory framework for payment stablecoins in the United States. By aligning with stringent federal and state financial regulations, the Act ensures that stablecoin issuers operate with transparency, financial stability, and consumer protection. Telcoin, having received conditional approval for a Digital Asset Depository Charter in Nebraska, is well ahead of the curve. It already meets the fundamental requirements of the GENIUS Act, making it a pioneering force in the regulated stablecoin sector. As the legislation moves forward, Telcoin’s strategic positioning within Nebraska’s progressive regulatory framework highlights its leadership in bridging digital assets with traditional banking in a compliant and forward-thinking manner.

Disclaimer

The information and content (collectively 'information') provided herein are general information. The authors do not guarantee the suitability or potential value of any information or particular investment source. Any information herein is not intended, nor does it constitute financial, tax, legal, investment, or other advice. The authors have no affiliation with Telcoin or other persons or companies referred to in this article. The information in this article is based on the sources used.