GSMA Proposes Stablecoin Framework to Revolutionize Global Telecom Payments

The GSM Association (GSMA) recently released a comprehensive whitepaper outlining a framework for the development of stablecoins in the global telecommunications industry. Co-authored with Telcoin members, the paper titled “Telco Stablecoin Development v1.0” proposes a standardized approach for mobile network operators (MNOs) to create and adopt blockchain-based stablecoins for use in cross-border settlements, digital financial services, and emerging digital ecosystems like the metaverse and IoT.

The paper highlights the urgent need for more efficient, secure, and cost-effective financial transactions across telecom networks. Stablecoins—digital assets pegged to fiat currencies or a basket of assets—could enable telcos to streamline international settlements, reduce currency exchange costs, and offer financial services to underbanked populations, particularly in emerging markets.

According to GSMA, a global telco consortium-backed stablecoin could operate similarly to the Special Drawing Rights (SDRs) used in roaming settlements today. This “electronic SDR” (eSDR) or localized stablecoin would allow telecom operators to leverage blockchain technology to digitize value exchange, facilitate instant peer-to-peer transactions, and support programmable finance use cases such as automated IoT payments and micropayments.

The whitepaper explores the technical, legal, and financial considerations required to launch a compliant stablecoin system. Key elements include:

· Regulatory compliance across jurisdictions, especially for licensing, AML/KYC, and data privacy.

· Stablecoin design options, including collateralized and algorithmic models, and their impact on price stability and adoption.

· Blockchain/DLT infrastructure evaluation, with Ethereum, Hashgraph, and Bitcoin Lightning among the candidates.

· Risk management strategies covering financial crime, cybersecurity, liquidity, and governance.

· Integration with mobile financial systems (MFS) to ensure usability and local accessibility.

Importantly, GSMA recommends a phased approach, starting with wholesale applications such as inter-operator settlements. Retail use, while promising for financial inclusion and digital payments, would require more complex compliance measures and regulatory oversight.

The paper envisions a global stablecoin API that telecoms could integrate into their apps, enabling seamless on- and off-ramp conversions, real-time transfers, and access to a unified FX market. This would reduce fragmentation in the stablecoin ecosystem and support telcos in monetizing new financial infrastructure through transaction fees, treasury yields, and market-making roles.

GSMA acknowledges the challenges ahead—particularly in aligning multi-jurisdictional regulation and managing operational risk—but argues that the potential rewards are transformative. With telcos’ global footprint, customer base, and capital capacity, the industry is uniquely positioned to lead the way in building a compliant, scalable digital currency infrastructure.

As stablecoins gain global traction in banking and fintech, GSMA’s proposal could place the telecom industry at the center of the digital financial revolution. The paper concludes with high-level recommendations and invites stakeholders to begin technical and regulatory consultations aimed at developing a minimum viable product (MVP) for telco-backed stablecoin deployment.

For more information, the full GSMA whitepaper is available under the title “Telco Stablecoin Development v1.0” dated 17 March 2025.

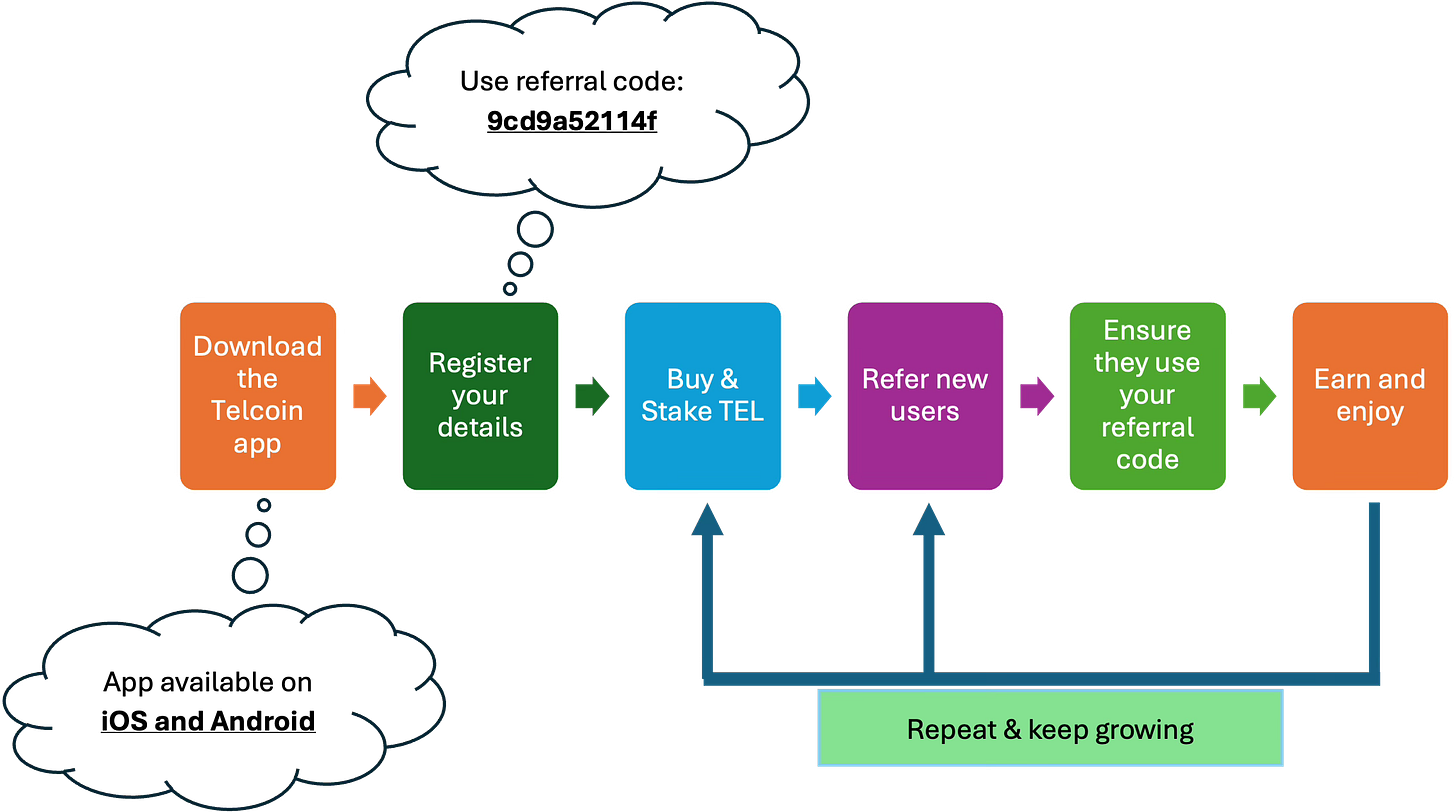

DID You know: Telcoin App users can stake TEL, refer new users, and earn up to 42% of their referred users’ trading fees!!! They also share 3.2 million TEL each week as rewards. Follow the steps below to participate. Click on the infographic to download the Telcoin App