Telcoin’s journey to global adoption has begun.

Telcoin started the second quarter of 2023 with a bang launching services in Europe. On April 4, Telcoin launched EU operations, starting with deposit and withdrawal functionality in Lithuania. The services were extended to Germany, Netherlands, and Portugal a couple of weeks later. It is expected that other countries will be added as well in the coming weeks.

The developments in Europe are essential steps toward achieving a “vision of global financial sovereignty and adoption," as reflected in Telcoin Community Update 7. In 2021, CEO Paul Neuner indicated that the application layer (V3) would serve as “the backbone of a global movement in mobile financial services — a perfect marriage between traditional fintech and blockchain that puts users at the heart of a global ecosystem designed for their benefit.” We are now starting to see the fruits of this labor-intensive process of developing "a version of the product that will be primed and ready for greatly increased marketing and deeper global scalability” that Neuner spoke of back in 2021.

DID YOU KNOW: The Telcoin App is your mobile access point to the entire suite of user-owned Telcoin products, including a fast and affordable fiat remittance portal and a digital wallet on the Polygon Network. Simply download the Telcoin App on your smartphone and begin Sending Money Smarter.

A surprise partner for Telcoin

Marketing and deeper global scalability that Neuner spoke of require an engagement with "new partners and enter additional geographies." This is over and above partnering with MNOs.

Critical to Telcoin is being able to offer on/off ramps globally. Users worldwide must be able to cash into Telcoin using their debit card or bank account. Only then will the dream of true financial inclusion be realized. For this, Telcoin should have a partner/service provider who will enable users to buy or sell crypto from the Telcoin app.

Telcoin has worked with Wyre Payments, Inc and Midwest Bank in the US. But who would they partner with for global payments, and when?

A brief search shows that Telcoin has already found a partner who could enable on/off ramps globally. As reflected in the Telcoin Terms of Use, Telcoin has partnered with Transak to enable users to buy or sell crypto from the Telcoin app. This significant development will undoubtedly take Telcoin to the next level.

Transak is a global leader, available across 160 cryptocurrencies on 75+ blockchains via cards, bank transfers, and other payment methods in 150 countries. Partnering with Telcoin, therefore, will help Telcoin realize its goal of "greatly increased marketing and deeper global scalability.” By any measure of imagination, this is a gigantic step towards a perfect marriage between traditional fintech and blockchain that will enable deeper global scalability.

Compliance key to taking over Europe

While Telcoin has not officially announced its partnership with Transak, they have announced the launch of operations in the European Union. This is yet another big step towards global adoption in a regulatory-compliant manner.

Europe is an essential test of Telcoin's compliance-first strategy. Unlike the US, the EU has put together a very clear regulatory roadmap. Given the regulatory complexities, whoever complies with EU regulations will likely become the industry leader. Getting regulatory approval is not just about completing paperwork. It's about putting systems in place, which takes time and effort. Most cryptos are start-ups. Consequently, it will be challenging to meet the regulatory requirements because of the lack of resources, systems, infrastructure, and skills.

It is, therefore, crucial for Telcoin to accelerate its compliance with the EU – and become a recognizable leader in the industry.

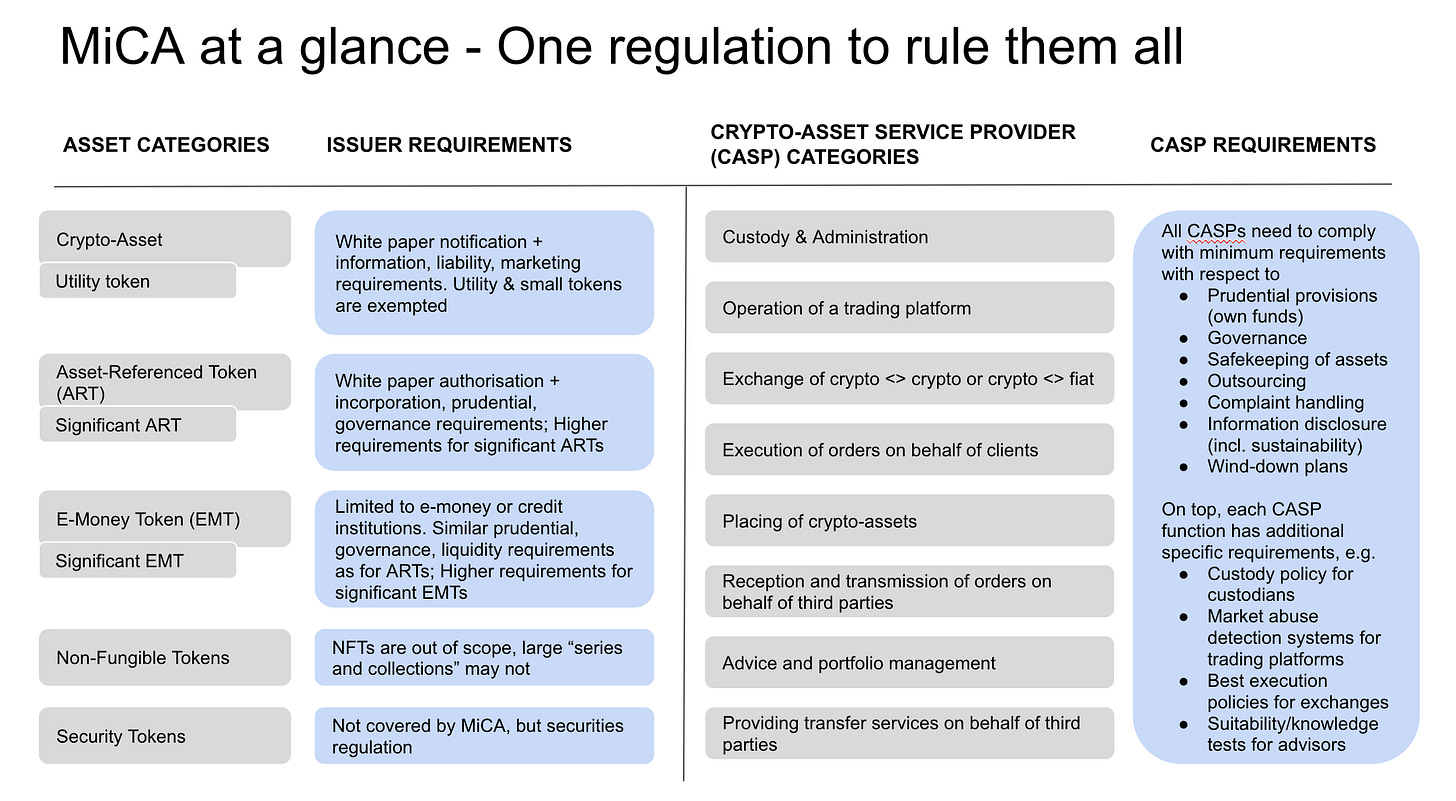

One of the regulations that Telcoin will have to comply with is the Markets in Crypto-Assets (MiCA) regulation proposed by the European Commission in September 2020. MiCA aims to establish a legal framework for crypto-assets in the EU and ensure effective and harmonized access to the innovative crypto-asset markets across the single market. The regulation will apply directly across the EU without any need for national implementation laws, and it has four essential objectives:

Ensuring legal certainty by establishing a sound legal framework for crypto-assets in its scope that are not covered by existing financial services legislation;

Supporting innovation and fair competition to promote the development of crypto-assets by instituting a safe and proportionate framework;

Protecting consumers, investors, and market integrity in consideration of the risks associated with crypto-assets; and

Ensuring financial stability, including safeguards to address potential risks to financial stability.

The entry into application of the Markets in Crypto-Assets regulation was initially expected by mid-2023. However, it is delayed to the end of 2024 (at the latest) as an 18-month period is foreseen to allow level 2 measures to be adopted before the application of MiCA.

Regulating utility tokens

The MiCA regulation will apply to most crypto-assets not already governed by other regulations. MiCA classifies crypto-assets into three distinct categories, as follows:

Asset-referenced tokens: These are crypto-assets that aim to maintain a stable value by referencing other values or rights, including official currencies, fiat currencies, commodities, or a combination thereof. This category includes stablecoins backed by multiple fiat currencies, crypto-backed stablecoins, and commodity-backed stablecoins.

E-money tokens: These are crypto-assets that maintain a stable value by referencing the value of a single official currency. This category includes stablecoins backed by a single fiat currency.

Other crypto-assets, including utility tokens: This category encompasses all other crypto-assets that are not asset-referenced or e-money tokens. Utility tokens are specifically designed to provide access to goods or services offered by the token issuer.

According to Telcoin, TEL is the native utility token of the user-owned decentralized Telcoin Platform. Therefore, as the issuer of a utility token, Telcoin must comply with MiCA.

Whitepaper requirement

Issuers of crypto-assets, excluding asset-referenced tokens or e-money tokens, must comply with specific EU regulations. Perhaps most important is that they must publish a crypto-asset whitepaper, which needs to be notified to the competent authority 20 working days before its publication. The crypto-asset white paper should contain information about the offeror or the person seeking admission to trading (i.e., Telcoin), the offer to the public or admission to trading of crypto-assets, the crypto-asset and its associated rights and obligations, risks related to the crypto-assets, the underlying technology used, and the environmental and climate-related impact of the consensus mechanism used for issuing the crypto-asset whether such a whitepaper would need to be made public remains unclear.

In December 2017, Telcoin published a whitepaper that was not updated. Nonetheless, I would be surprised if Telcoin failed to comply with this requirement. They already provide extensive information on their websites, which should easily be translated into an official whitepaper. I'd argue that an updated whitepaper exists, even though it has not been made public.

Marketing regulations

In 2021 Telcoin committed to greater marketing of its products. According to MiCA, marketing communications related to the offer to the public or admission to trading of crypto-assets, excluding asset-referenced tokens or e-money tokens, must be fair, clear, not misleading, and consistent with the information provided in the crypto-asset white paper. Once again, this requirement does not seem too cumbersome for a compliance-first company such as Telcoin.

What I struggle to understand is that according to Mica, the whitepaper and marketing communication requirements do not apply to issuers of crypto-assets in the following cases:

When the offer is addressed to fewer than 150 natural or legal persons per EU member state.

When the offer is solely addressed to qualified investors.

When the total consideration of the offer to the public of crypto-assets in the EU does not exceed 1,000,000 euros within 12 months.

I am not sure how these criteria will be quantified. For example, how would Telcoin quantify the total TEL offered to the EU public to ensure it does not exceed 1,000,000 euros within 12 months? We’ll wait and see. In my view, given this complication, Telcoin would do well in pursuing holistic compliance.

Crypto-asset services providers

MiCA also states that crypto-asset service providers, also known as CASPs, are regulated under MiCA and are required to fulfill certain general obligations. If Telcoin plans to offer “to provide rails to its crypto wallet and DeFi exchange for EU customers," as announced in November 2022, it will do so as a crypto-asset services provider.

Consequently, Telcoin would be obliged to obtain authorization from a competent authority in an EU member state, meet minimum share capital requirements, act in the best interest of clients, safeguard clients' crypto-assets and funds, maintain a good reputation, and possess the necessary knowledge, experience, and skills, implementing appropriate policies and procedures for anti-money laundering (AML), continuity of services, and data security, establishing effective procedures for handling complaints, preventing conflicts of interest, and having a plan for an orderly wind-down of activities without causing undue economic harm to clients.

The fact that Telcoin already has authorization from a competent authority in an EU member state (i.e., Lithuania) means this huddle has already been crossed. This is important as it means Telcoin launching to the rest of the EU could be fast-tracked.

It is also worth noting that according to legal experts in Lithuania, “since Lithuanian regulator performs authorization of crypto companies, already authorized companies (such as Telcoin) will be subject to a simplified authorisation process. Such companies will be exempted from the obligation to provide information and documents already known to the regulator. Additionally, already authorised companies will have an 18-month grace period to operate before obtaining authorisation under the MiCA regulation." I suspect that Telcoin knew of this before registering in Lithuania. They did so to be at least 18 months ahead of everyone else. Always remember, Telcoin’s view is that “a year in crypto can feel like multiple years compared to traditional markets, or to be precise, a crypto year is more like 5.347 years in the legacy world.”

Bottomline

Telcoin's compliance-first approach means the company is well-prepared to implement the MiCA regulation. By complying with the MiCA regulation, Telcoin can offer its services to a wider range of consumers across the EU, ultimately benefiting TEL and its holders. Given the extensive consultation, and the overall EU economy, I wouldn't be surprised if other regions adopt regulations similar to the MiCA regulation – and this would most definitely put Telcoin where it belongs – at the forefront of crypto. With a partner like Transak, Telcoin is undoubtedly on the path to global dominance.

DID YOU KNOW: Telcoin users can Stake and Earn unto 42% of their referred users’ trading fees. Its simple, download the Telcoin App on your smartphone to get started. Tap below to get started!!!

Disclaimer

The information and content (collectively 'information') provided herein are general information. The authors do not guarantee the suitability or potential value of any information or particular investment source. Any information herein is not intended, nor does it constitute financial, tax, legal, investment, or other advice. The authors have no affiliation with Telcoin or other persons or companies referred to in this article. The information in this article is based on the sources used. Some of the images used were sourced from the internet; relevant links are provided.