In today’s digital age, managing finances has become more accessible, with two primary methods emerging: traditional mobile money wallets and blockchain-based wallets. Understanding the advantages and disadvantages of each can help users make informed decisions about their financial management. Additionally, we’ll explore how the Telcoin App, a blockchain-based solution, offers unique benefits in this context.

Mobile Money Wallets: Pros and Cons

Mobile wallets, such as Apple Pay and Google Pay, have gained tremendous popularity in recent years. These apps allow users to store card information securely on their smartphones, enabling quick and easy transactions through QR codes or NFC technology. They not only streamline the payment process but also integrate loyalty programs and digital receipts, enhancing the overall shopping experience.

However, mobile wallets are not without their drawbacks. Being connected to the internet exposes them to potential hacking attempts and malware, posing security risks. For instance, vulnerabilities in contactless payment systems have been identified, where cardholder information could be transmitted without encryption, making it susceptible to unauthorized access. Additionally, mobile platforms may collect user data for various purposes, potentially compromising the privacy of wallet users.

A concerning example involves the ‘Ghost Tap’ scam, where cybercriminals clone cards linked to mobile wallets like Google Pay and Apple Pay. This allows them to make unauthorized purchases without needing the physical card or phone, leading to significant financial losses for victims.

Blockchain-Based Wallets: Pros and Cons

Blockchain wallets offer a different approach by providing enhanced security and transparency. They employ advanced encryption techniques and robust security measures to protect private keys from unauthorized access. Transactions recorded on the blockchain are transparent and immutable, reducing the risk of fraud and ensuring a clear transaction history.

However, managing private keys requires a certain level of technical understanding, which might be daunting for some users. Additionally, blockchain transactions are irreversible; any mistakes, such as sending funds to the wrong address, cannot be undone.

The Telcoin App: Bridging the Gap

The Telcoin App is a blockchain-based platform that aims to combine the benefits of traditional mobile wallets with the security and transparency of blockchain technology. Here’s how it stands out:

Despite being blockchain-based, the Telcoin App offers an intuitive interface, making it accessible even to those unfamiliar with blockchain technology. Users can securely store supported digital assets in an easy-to-use multi-signature wallet with assisted self-custody.

Telcoin leverages blockchain technology to facilitate low-cost, high-quality financial products, including remittances, making it a viable alternative to traditional money transfer services. Users can send fast and affordable remittances from their bank or digital asset balance to more than 40 popular e-wallets in over 20 countries.

Users maintain control over their assets with self-custodial wallets, enhancing security and reducing reliance on third parties. The Telcoin Wallet enables users to securely store, send, and swap more than 100 digital assets on popular DeFi protocols with just a few taps on their smartphones.

Telcoin partners with mobile operators to bring cryptocurrency services to the masses, particularly in regions where traditional banking services are limited or unavailable. This integration aims to provide low-cost, high-quality financial products for every mobile phone user in the world.

The app supports a wide range of digital assets, allowing users to store, send, and trade various cryptocurrencies seamlessly. Users can trade digital assets effortlessly using the Telcoin Mobile Application, powered by the Polygon Network and DeFi swap protocols for swift and cost-effective transactions.

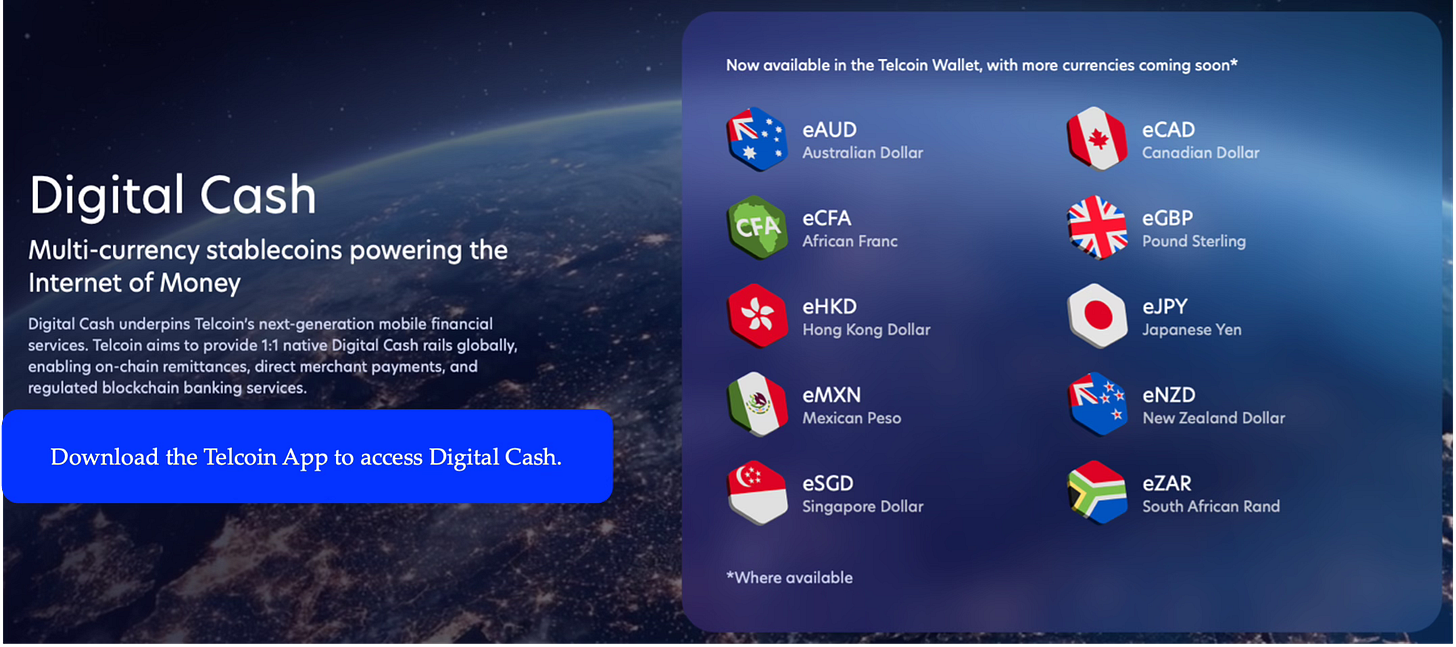

Digital Cash: A Key Feature

A standout feature of the Telcoin App is its Digital Cash service, which utilizes multi-currency stablecoins to power next-generation mobile financial services. Digital Cash serves as the backbone of Telcoin’s financial offerings, enabling users to transact seamlessly across borders without the volatility typically associated with cryptocurrencies.

In the near term, Digital Cash will underpin Telcoin’s next-generation remittance services, support multi-currency payments, and power on-chain transactions, providing users with a stable and efficient medium for financial activities.

Bottom line

Both traditional mobile money wallets and blockchain-based wallets have their advantages and drawbacks. Mobile wallets offer convenience and integration with existing financial systems but may pose security and privacy risks, including potential exposure of card information to scammers and hackers. Blockchain wallets provide enhanced security and transparency but can be complex for the average user. The Telcoin App bridges this gap by offering a user-friendly, secure, and cost-effective platform that leverages blockchain technology while ensuring accessibility for all users. Its integration with mobile networks, support for diverse digital assets, and innovative services like Digital Cash make it a compelling choice for modern financial management.

Disclaimer

The information and content (collectively 'information') provided herein are general information. The authors do not guarantee the suitability or potential value of any information or particular investment source. Any information herein is not intended, nor does it constitute financial, tax, legal, investment, or other advice. The authors have no affiliation with Telcoin or other persons or companies referred to in this article. The information in this article is based on the sources used.