Ever wondered just how big Telcoin's remittances and mobile money market is? Well, I have. Note these numbers: 5 years, over 200 million users, 22 mobile money service providers, 16 countries. Also note the graph below.

I’ll $TEL you why…

Telcoin was founded just over 5 years ago in 2017. The first two years were turbulent. The company has evolved much, but its founding focus remains. Telcoin has positioned itself as a major player in blockchain-based financial services, which partners with mobile network operators. Through its Rivendell network, Telcon will enable "mobile networks to provide blockchain-based, non-custodial financial services to their subscribers - without needing to be a bank or custody funds." In line with its objectives, Telcoin joined the GSMA as an associate member, becoming the first telecom-focused cryptocurrency distributed in partnership with GSMA network operators to mobile subscribers globally. Through its Chief Commercial Officer, Telcoin has participated in several GMSA events to establish partnerships with MNOs as it seeks to dominate blockchain-based financial services.

But is it worth it?

To appreciate the mobile money industry, let's consider the views of the United Nations Secretary-General's Special Advocate for Inclusive Finance for Development (UNSGSA), Queen Máxima of the Netherlands. The UNSGSA office is based at the United Nations Development Programme (UNDP) in New York. They work closely with various partners, including UN member states, international organizations in financial inclusion, regulatory bodies, financial institutions, companies, donors, and civil society organizations. They also work with the World Economic Forum and the Bill & Melinda Gates Foundation.

Outside of politics, the UNSGSA seems a potentially valuable partner for a company such as Telcoin. The UNSGSA already works with the GSMA to the extent that Queen Máxima wrote the foreword of the mobile money industry report of the GSMA. Therefore, a Telcoin partnership with the UNSGSA could open access to the greater global community with a shared vision of financial inclusion.

In her foreword, Queen Máxima notes that in 2012, "mobile money was a nascent money transfer service operating in a handful of markets". By 2021 over a trillion dollars' worth of transactions were processed through mobile money, including payments for groceries, school fees, salaries, loans, and remittances. This assessment by Queen Máxima is quite vital. Financial inclusion does not only mean banking the unbanked. It means people can pay their children's school fees, without needing bank accounts, which most of us take for granted. Financial inclusion means people who do not have access to bank accounts can receive salaries on their phones, reducing the risks of robberies in case they carry cash. Financial inclusion means ordinary poor, rural women, and smallholder farmers in third-world countries will be able to Send Money Smarter and Store Money Smarter.

But is mobile money economically worth it for Telcoin?

I’ll let you answer that question… It's one thing to want to be a humanitarian, but to do so and do so effectively, you need to have resources. Financial resources.

According to the GSMA Mobile Money report, over 1.35 billion registered mobile money accounts are processing about $2 million per minute of transactions daily. Yes, TWO big ones every 60 seconds.

Of the 1.35 billion registered mobile money accounts, 605 million accounts are in Sub-Saharan Africa, and 328 million are in Southeast Asia. In Southeast Asia, registered mobile money accounts grew by 30%, while transaction value grew by 21% to reach $142 billion. In and near this region, Telcoin users can already send money from the US and Canada to Fiji, Indonesia, the Philippines, Tonga, and Samoa. In Africa, mobile money accounts grew by 17% in 2022, with transactions rising by 39% to $701 billion. Most of this growth occurred in West Africa, where transaction value increased by a whopping 60% reaching $239 billion. Southern Africa and Eastern Africa grew by an impressive 42% and 31%, respectively. There is a phrase in Africa that says, "Africa is open for business," and boy, it's open! While Telcoin does not have offices in Africa, it is essential to note that Telcoin users can send money from the US and Canada to five African countries, i.e., Ethiopia, Ghana, Kenya, Malawi, and Uganda. That is a third of all Telcoin remittances/mobile money destinations.

While the mobile money stats above are impressive, what is more impressive is that Telcoin has partnerships with at least 22 mobile money operators in 16 countries through whom remittance recipients transact. These include MNO giants Digicel, MTN, Airtel, GCash, and many others. What is even more impressive is the number of users that Telcoin has access to. For example, Telcoin's partner, bKash, has at least 23 million users in Bangladesh. Tigo Money in El Salvador and Guatemala has 5 million users. Digicel in Fiji has over 13.6 million users. MTN Ghana, 28 million. Ovo Indonesia, 21 million. Gopay Indonesia, 38 million. GCash the Philippines, 60 million. Airtel and MTN Uganda have 7.2 million and 15 million users, respectively. I have left out a whole lot of other MNOs. I counted just over 200 million users. These users may not be using Telcoin services currently, but they have accounts with their respective mobile money services providers – who are direct partners with Telcoin. They are likely to start using Telcoin services once the Rivendell Network is activated. That is a baseline of at least 200 million users folks, and, we are still talking about proof of concepts. Greater partnerships are still coming. Let that sink in.

What we are seeing in mobile money is the network effect. I discussed this in detail in a previous newsletter. The network effect is a phenomenon whereby a user's value or utility from a good or service is influenced by the quantity of customers who also use related goods. The majority of the time, positive network effects lead to a user getting more value out of a product as more users join the same network. The number of users is increasing rapidly. In 2012, there were less than 50 million registered mobile money accounts. By 2021, over 1.35 users were registered. The value and quality of mobile money services is improving overtime. That is the network effect.

I posit that Telcoin's user growth will follow the same trajectory. Again, we are still in the genesis – probably about to enter the next phase as the TELx, and SMS network have proven stable over the last 18 months. While others are busy providing proof of reserves, Telcoin has, in my view, offered solid proof of concept – working with 22 mobile money services providers in 16 countries.

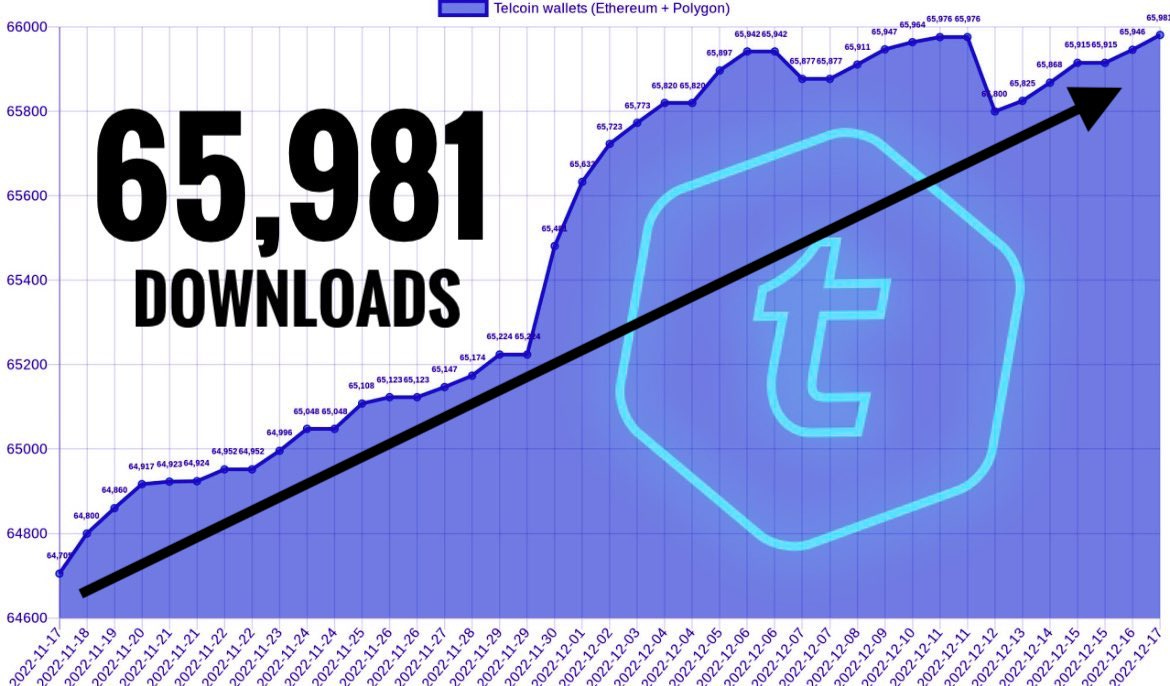

Telcoin’s systems are improving, which will lead to an improved experience as more people participate, but it can also encourage new participants as they look to benefit from the network. Network effects are known to create exponential growth rates. Perhaps it's not surprising that downloads on the Telcoin app have seen exponential growth since the collapse of FTX, and this is only the beginning.

Just over 5 years old, access to over 200 million users, through 22 mobile money service providers, in 16 countries, that’s perfect exponential growth.

I hope you get it. If not, read again.

Disclaimer

This article will be updated as and when new information becomes available.

The information and content (collectively 'information') provided herein are general information. The authors do not guarantee the suitability or potential value of any information or particular investment source. Any information herein is not intended, nor does it constitute financial, tax, legal, investment, or other advice. The authors have no affiliation with Telcoin, or other persons or companies referred to in this article. The information in this article is based on the sources used.