In 2022, I wrote a newsletter saying "Know What You Hold". In that letter, I argued that it will soon become one of the most valuable assets in the crypto Industry. I argue that at least two factors will drive TEL value. These are: a) TEL as a medium of exchange and b) TEL as a standard of value.

DID YOU KNOW?

Telcoin Application users can stake TEL, refer new users, and earn up to 42% of their referred users’ trading fees!!! Simply download the Telcoin App to get started

Don't miss out on this opportunity to take charge of your finances and join the DeFi revolution!

TEL as a Medium of Exchange

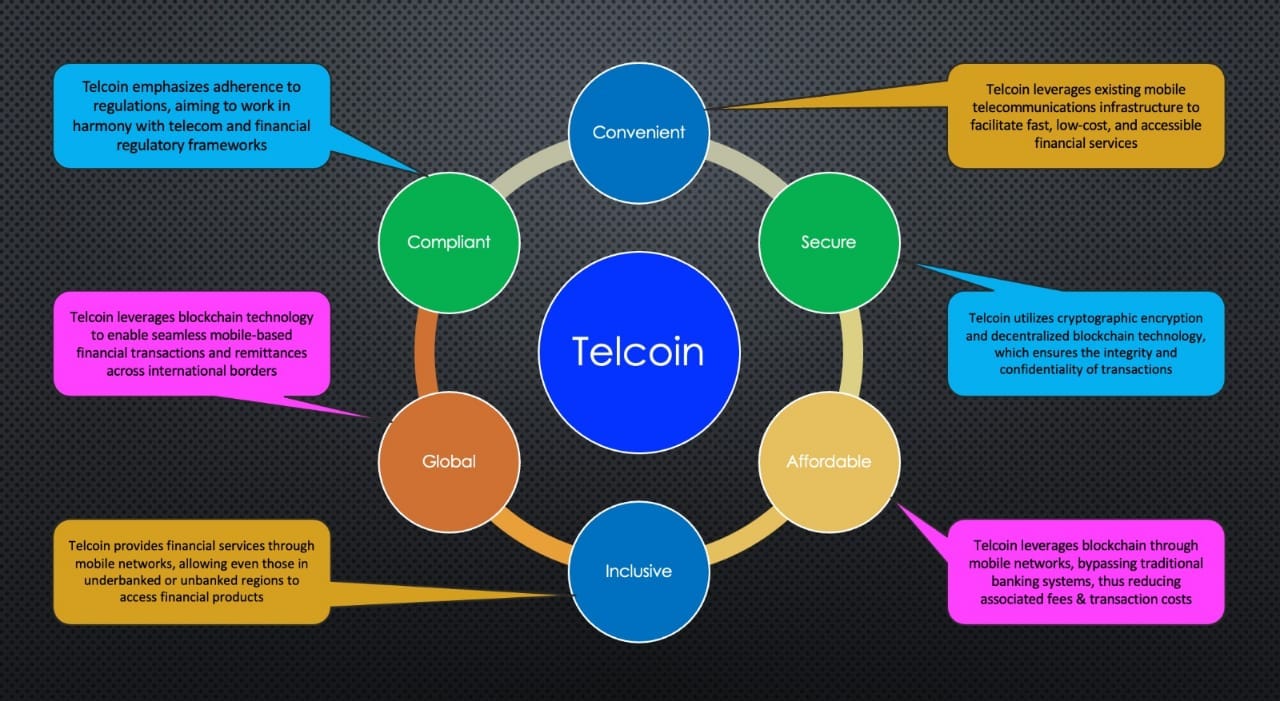

Simply put, a “medium of exchange is any item that is widely acceptable in exchange for goods and services." In the crypto context, such an item facilitates the sale, purchase, or trade of other crypto assets in the ecosystem. For example, money is generally used as a medium of exchange used to buy, sell, or exchange items. In the US, for example, the US Dollar is used to determine the cost of services, cost of items, etc. In South Africa, we use the ZAR (South African Rand). If I need to travel to the US, then I need to convert (trade) my ZAR into USD to be able to buy and sell in the USA. This means to buy and sell crypto assets in the Telcoin ecosystem; you will need to use TEL because it is the medium of exchange. This is what TEL "is designed to be the most liquid, cost-effective asset to transact with on the platform."

TEL as a Standard of Value

As a medium of exchange, TEL will represent a standard of value. This means the value (price) of other assets is measured against TEL. For example, currently, we say one BTC is worth 40 000 USD. Why USD? Because the USD is the most common medium of exchange used as a standard of value. People use USDs to buy BTC (of course, they may convert it to USDT, USDC, or other stablecoin before buying BTC, or they may buy BTC directly, depending on the platform they use). In the Telcoin ecosystem, therefore, the value of other assets will be measured against TEL because TEL "is designed to be the most liquid, cost-effective asset to transact with on the platform."

Why am I bringing the above back? Here's why.

On September 13, Telcoin CEO Paul Neuner announced that Telcoin had "greatly expanded the list of digital assets supported by the Telcoin App.” Explaining this expansion, Josh Worley, VP Design, indicated that Telcoin had “decided to significantly increase asset availability from the current 28 to 110 tokens, with many more anticipated in the future.” By comparison, CoinMarketCap indicates that "Over 150 crypto assets can be traded on” Coinbase. Investopedia reports that Binance US has “More than 150 tradable cryptocurrencies" while Binance Global has “more than 350”.

Of course, this is not a numbers game. But what is critical is that the number of assets traded on the exchange drives up the demand for the medium of exchange. For example, on August 1, 2017, the price of BNB was $0.0961. On May 10, 2021, it was $690.93. I'll let you do the math. There are many factors behind this exponential price increase, one of which is the volume traded on the exchange – which is driven by the number of assets traded.

Now look at (the late) FTT. In December 2019, it was hovering at around $1.8. By May 2021, it had reached an all-time high of $85.

Why these two, BNB and FTT? Firstly, because Telcoin is fast becoming a serious challenger to Binance US. It is common knowledge that Binance is under several investigations in the US and other countries. Most recently, several high-ranking executives resigned from Binance US. Coindesk reports that Binance US “has lost two more high-level executives, not long after the crypto exchange lost CEO Brian Shroder amid intensifying regulatory scrutiny. Head of Legal Krishna Juvvadi and Chief Risk Officer Sidney Majalya are leaving the company, the Wall Street Journal reported, citing people familiar with the departures. Juvvadi was hired in May last year, and Majalya was appointed in December 2021. A company spokesperson declined to comment.”

A CEO, the Head of Legal, the Chief Risk Officer, and the company spokesperson declined to comment. Wow.

Here is a question: who could replace Binance US as a reliable, compliant alternative, particularly trusted by US authorities and ordinary American citizens? I'll give you a hint: it is the company that helps the US government draft a customer-friendly regulatory framework.

Now, let’s go to FTX.

It would seem to me that Telcoin is one of a few companies that have carefully studied FTX, understood what it collapsed, and learned lessons to ensure Telcoin does not face the same demise.

Consider the recent statement by Telcoin CEO, who said, "I am happy to say that we now have the foundational infrastructure in place to satisfy the most stringent requirements of central banks globally — a milestone that, despite its brand recognition, FTX certainly never met." This is an important statement because it suggests that Telcoin knows what went wrong at FTX and what the regulators will demand from any aspiring crypto exchange to avoid another FTX-like catastrophe. I dare say Binance US does not have the "foundational infrastructure in place to satisfy the most stringent requirements of central banks globally” spoken of by Neuner.

I may also state here that I have always suspected that US authorities are stalling on Binance. Being careless about this would seriously impact the crypto markets and perhaps global financial markets – more so given that the bear market hasn't subsided. The financial markets have also not recovered from the Covid-19 pandemic. Therefore, while the writing is on the wall on Binance, timing is most crucial.

The genius of Telcoin then is here: Build in winter, enjoy in summer.

In the middle of the bear market, Telcoin launched in Europe, significantly increased the number of assets on its platform, built a reliable platform capable of handling a high number of transactions, and built a foundational infrastructure that will satisfy the most stringent requirements of central banks globally. At the heart of all of this, they have laid a solid foundation for a “multi-level architecture, composed of an application layer (the Telcoin app), a liquidity engine (TELx), and a settlement network (Rivendell). Powered and coordinated by the TEL token, these parts combine to form the Telcoin suite of mobile-based, user-owned, decentralized financial products.”

One thing is inevitable now: the volume of the Telcoin platform is about to increase significantly. This increase will be driven by several factors, including:

Bitcoin halving (in less than a year), leading us to the next bull market;

The ability to trade and self-custody over a hundred cryptos on the Telcoin platform.

A migration from centralized exchanges to decentralized ones. With this, a possible collapse of Binance US forcing customers to find a reliable, trustworthy, and compliant alternative

Implementing a global regulatory framework will force the closure of many crypto companies that, like FTX, will not meet the stringent requirements of central banks globally.

Now, here is the sweet spot: When the above happens, TEL will truly become the medium of exchange and standard of value that it was created to be, and whatever was meant to happen to the value of TEL will happen.

I hope you see what I see.

Disclaimer

The information and content (collectively 'information') provided herein are general information. The authors do not guarantee the suitability or potential value of any information or particular investment source. Any information herein is not intended, nor does it constitute financial, tax, legal, investment, or other advice. The authors have no affiliation with Telcoin or other persons or companies referred to in this article. The information in this article is based on the sources used.