Africa is a complex continent, geopolitically and economically. The continent is home to over 1.2 billion people speaking between 1000 and 2000 indigenous languages, making Africa home to about a third of the world's languages. There are 54 countries in Africa and they have divided themselves into economic regions. These are UMA (the Arab Maghreb Union for North African countries), ECOWAS for the West African Francophone countries, ECCAS for the central African region, and COMESA, which includes the Southern African and East African countries. Sometimes, the COMESA works as SADC (Southern African Development Community) and EAC (East Africa Community).

This level of diversity means it is politically and economically challenging for the continent to develop overarching policies. For example, traveling between some African countries is more difficult than traveling to Europe or America. These complexities make it difficult for different industries to thrive.

The one industry that has been exceptionally successful in Africa is the mobile economy, which includes mobile communications and financial services. For example, MTN is a South African company that operates in 19 markets. Similarly, based in South Africa, Vodacom has grown its operations to include networks in Tanzania, the DRC, Mozambique, and Lesotho. It also provides business services to customers in over 32 African countries, including Nigeria, Zambia, Angola, Kenya, Ghana, Côte d'Ivoire, and Cameroon. In the finance sector, some banks have also successfully broken geopolitical boundaries and offered services in multiple countries across different economic regions.

Therefore, anyone willing to pursue business in Africa needs to have a good understanding of the context, and ideally partner with companies with a footprint across different nations. With that, let's explore partnerships that Telcoin has in the continent and how these may grow in the future.

Telcoin Partners in Africa

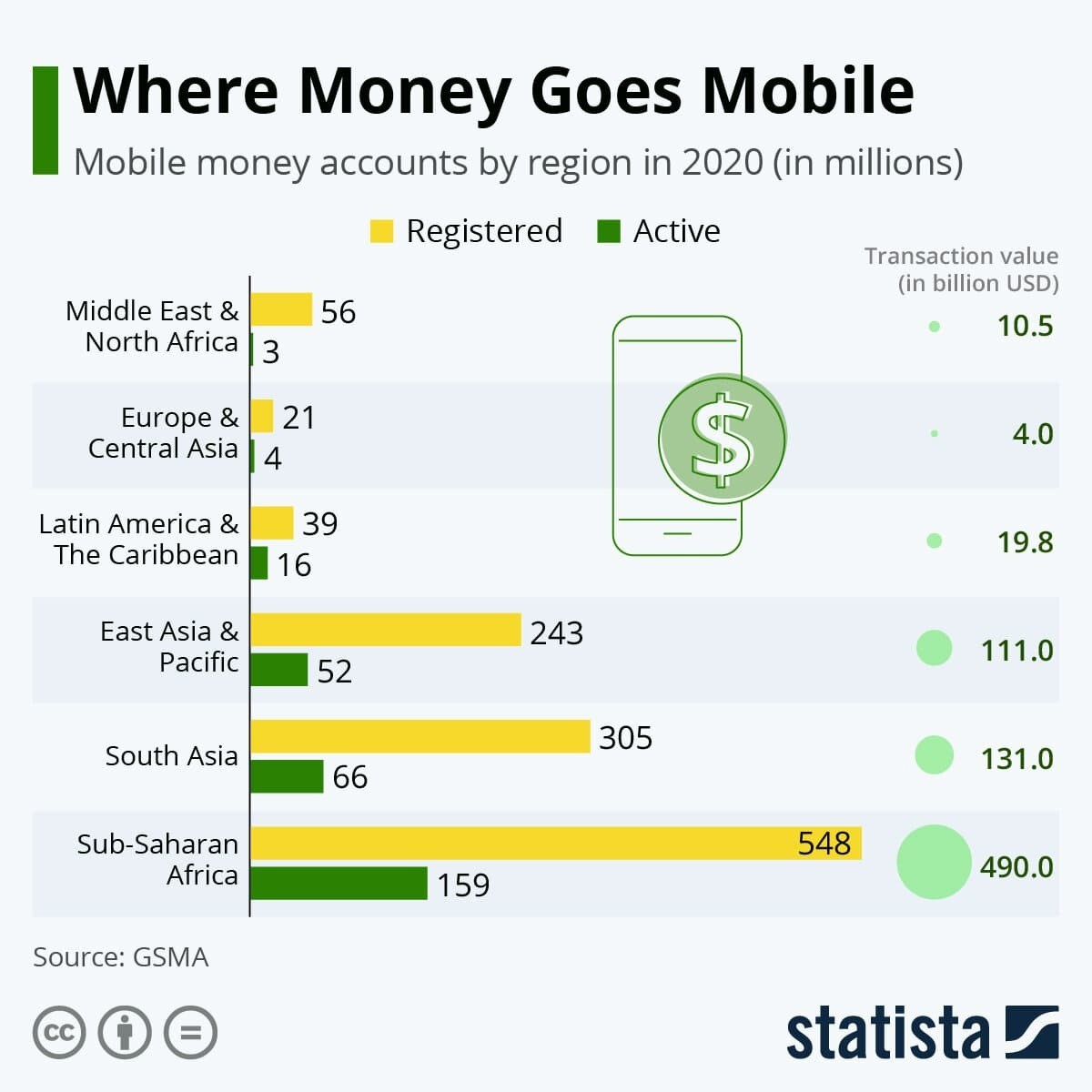

In addressing Telcoin in Africa, I will look at three economic powerhouses in Sub-Saharan Africa: Nigeria, Kenya, and South Africa. I'll explain why. (For those who may not know, Sub-Saharan Africa refers to the area and regions of the continent of Africa that lies south of the Sahara. These include West Africa, East Africa, Central Africa, and Southern Africa.)

Located in West Africa, Nigeria is the most populous country in the continent, with a population of over 200 million and a GDP of $440 billion. Kenya is on the opposite end of the continent, East Africa, with a growing population of 53 million and a GPD of $110 billion. South Africa is found at the bottom tip of the continent, with a population of 60 million, and a GDP of $419 billion. (I must say, South Africa is the most beautiful of them all – and I know my Kenyan and Nigerian friends won’t agree, and that’s ok😊)

These three countries have much in common, including one mobile network operator, MTN. Telcoin users in the US and Canada can send remittances to MTN subscribers in Ghana and Uganda. Users in Nigeria, Kenya, and South Africa are not yet able to receive these remittances – but the opportunity is enormous. Here’s why:

MTN Nigeria has over 82 million subscribers as of November 2022, up from 70 million in January of the same year. In South Africa, MTN has 31 million subscribers. In October 2022, MTN GC launched customer success centers in Kenya and Ghana. In 2015, the MTN group had about 232.5 million subscribers, by end of 2021, that number had increased to 272.4 million. MTN reports that their data and fintech revenue were up by 34.5% and 35%, respectively, in the quarter ending September 2021. The number of active MTN Mobile Money (MoMo) customers increased by 2.2 million to 51.1 million in the same quarter. MoMo's value of transactions was up by 67.2% year on year to US$175.5 billion.

MTN further reports that “MoMo active monthly users grew by 22.3% YoY and the average volume of transactions processed through our fintech platform was up 29.6% in Q3 YoY to 19 416 per minute. The value of transactions increased by 67.2% YoY to US$175.5 billion. As (MTN) establish and scale (MTN) payment platform, the number of active merchants accepting MoMo payments increased by 58.3% YoY to 626 033 and the total value of MoMo merchant payments rose by 46.5% YoY to US$8.1 billion. In Nigeria, (MTN) added over 234 000 agents to end the quarter with over 630 000 registered MoMo agents. Fintech revenue rose by 35.0% YoY. The total value of remittances grew by 68.0% YoY to US$1.6 billion in Q3; in addition, (MTN) facilitated a total loan value of US$802.2 million, a 48.7% increase YoY. At the end of Q3, our InsurTech platform had 14.8 million registered insurance policies, reflecting growth of 51.7% YoY.”

These numbers are remarkable! But let’s leave MTN for a moment and go to Airtel.

Airtel is an Indian company, formally known as Bharti Airtel Limited. It is a multinational telecommunications services company based in New Delhi, operating in 18 countries across South Asia and Africa, 14 of which are in sub-Saharan Africa, including Malawi and Uganda. I am mentioning these two countries because Telcoin users in the US and Canada can send remittances to Airtel users in both Malawi and Uganda.

Airtel Money, a Mobile Commerce service (money transfer via the phone), allows users in sub-Saharan Africa to send and receive money across networks, make payments using airtel money (e.g., utility bills, goods & services), conduct bank transactions (check bank balances, send money from a phone to a bank account and from a bank to a phone), and make ATM cash withdrawal. In Malawi, Airtel reports that its customer base increased by 11% in the half-year ending June 2022. The revenue grew by 14.3%.

Further East of Africa, Telcoin users in the US and Canada can also send remittances to HelloCash in Ethiopia. HelloCash boasts over 2.2 million users and 25 000 outlets in the country. Their WebApp allows users to conduct various mobile money services, including direct payment, bill payments, sending money, and receiving remittances.

MTN and Airtel numbers show that Telcoin’s partners in Africa are doing well as mobile network operators and as mobile financial services providers. Really, well. However, there is one service – and market – that they have been unable to capture. Crypto. The primary reason in this regard has been the lack of a clear regulatory framework.

Crypto in Africa

According to an IMF report, “Africa is one of the fastest-growing crypto markets in the world, according to Chainalysis, but remains the smallest, with crypto transactions peaking at $20 billion per month in mid-2021. Kenya, Nigeria, and South Africa have the highest number of users in the region." As shown in the figure below, the regulators in Africa view crypto as posing moderate risks to financial inclusion, but they support its role in facilitating remittances. They also greatly support mobile money for financial inclusion and facilitating remittances. The IMF notes that transacting without a bank account or internet access makes mobile money particularly useful for low-income households. These views are crucial for Telcoin’s business strategy.

Regulators are generally concerned that "cryptocurrencies have been touted to promote financial inclusion and support remittances, their track record in these areas is limited, and they can pose risks to macroeconomic and financial stability." They suggest that clear regulations need to be developed.

A positive move in line with regulations is that South Africa’s regulatory body, the Financial Sector Conduct Authority (FSCA), has classified crypto assets as financial products. Cryptocurrency financial companies in South Africa must apply for a license between June 1 and November 20, 2023, to operate legally, the country's financial conduct regulator said.

This is good news as it may influence other African countries to allow crypto, even with some regulatory restructions. Crypto scams are also fairly common in Africa, damaging the industry. Some of the most damaging crypto scams have been Africrypt and Mirror Trading International. As a result, regulators in Africa have been trying to find a middle path that enables them to check on such scams while also ensuring that the benefits of cryptocurrencies can be realized.

What might Telcoin do?

It is common knowledge that Telcoin embraces regulations and will not see these regulatory moves as a threat. Whether Telcoin will apply to become a crypto services provider in South Africa is anyone's guess.

A key question is whether remittances from the US and Canada to Africa have yielded substantial revenue for Telcoin, and whether the strategy should not embrace mobile money more.

Looking at Telcoin remittance destinations, Ethiopia, Ghana, Uganda, Kenya, and Malawi might give us a clue. In 2021, Ethiopia received $4.2 billion worth of remittances. Ghana received $4.5 billion. Uganda, $1.1 billion. Kenya, $3.7 billion. Malawi, $258 million. These numbers include transactions through several service providers other than Telcoin. As shown earlier, mobile money is growing far more rapidly than remittances. M-Pesa (a Vodafone partner) reported 19.9 billion mobile money transactions in the financial year ending March 31, 2022.

I believe combining crypto, mobile money, and remittances will win the day in Africa rather than just remittances. A company that offers domestic payments, international remittances, and money markets will do well. If you add to that digital asset exchanges and regulated securities, you are home and dry. And this is precisely what Telcoin's Rivendell promises to offer. An ecosystem to power Telecom Mobile Financial Services 2.0. MTN, Airtel, HelloCash, M-Pesa, Vodafone, and others, will be thrilled to have a platform that enables them to provide blockchain-based, non-custodial financial services to their subscribers - without needing to be a bank or custody funds.

What to expect in 2023:

Based on the above, I expect a similar strategy in Africa as in Southeast Asia, with a spice of European strategy. In particular, I expect the following:

Telcoin will likely launch mobile money services in partnership with MTN, Airtel, Equitel, and HelloCash. They already have remittance partnerships, and therefore, these MNOs will likely become part of the Rivendell network.

Telcoin is likely to extend its upcoming DeFi crypto exchange services to Africa, even if the offices are based in Europe.

Telcoin may open offices in one of the three African countries, most likely, South Africa, because of its trade agreements with the West and for its infrastructure. The offices may not be operational in terms of providing services, but they provide a market analysis base and be used for license applications. To my knowledge, Lee-Ann Cassie, who was Telcoin's Regional Manager based in Nigeria, is no longer with the company. Julien Ghossoub, based in Dubai, is the Regional Sales Manager for Europe, the Middle East, and Africa. With 54 countries, and several economic regions, Africa is too large and complex.

You may recall that the initial step to register Telcoin as a company in South Africa was initiated with the reservation of the name. Most recently, the name is now classified as a "proposed name ."I expect that in 2023 the registration process will be finalized. If this happens, Telcoin will likely apply for a crypto exchange license.

Africa’s biggest huddle is regulation. This however is an opportunity for Telcoin. They could work with African governments to develop a regulatory framework. With the Nebraska experience, Telcoin could build a reputation as a trusted partner to help Africa develop regulations. Trust is important in Africa and is a key that opens the greatest of opportunities.

All things considered, Africa presents one of the most complex environments for Telcoin to operate. These complexities will likely scare competition away. This, in turn, becomes a significant opportunity for anyone daring. Binance is making inroads, but its regulatory issues will concern pro-West African countries. This means that Telcoin, an American company with licenses worldwide, has a big opportunity. Like an African lion, I hope they pounce on the opportunity without delay because Africa is for the future; and Africa is open for business.

You can download the Telcoin App to trade - store - send - stake and earn TEL incentives on the link below. Use referral code: db668e5f4e2

Disclaimer

The information and content (collectively 'information') provided herein are general information. The authors do not guarantee the suitability or potential value of any information or particular investment source. Any information herein is not intended, nor does it constitute financial, tax, legal, investment, or other advice. The authors have no affiliation with Telcoin or other persons or companies referred to in this article. The information in this article is based on the sources used.