In the first quarter of 2025 (Q1 2025), Telcoin reached critical milestones, positioning it as a frontrunner in bridging traditional, telecommunications, and decentralized finance. With landmark regulatory approvals, strategic partnerships, and product innovations, Telcoin demonstrated tangible market traction and strengthened TEL Holder confidence. As we enter the second quarter (Q2), Telcoin is poised for transformative developments—including the launch of Telcoin Bank, the introduction of the regulated eUSD stablecoin, anticipated major exchange listings, and advancements toward its proprietary blockchain mainnet. This update explores Telcoin’s significant Q1 achievements and provides an insightful preview of the strategic initiatives expected to accelerate growth and innovation through Q2 2025 and beyond.

Q1 2025 Highlights

• Regulatory Breakthrough

Telcoin achieved a landmark regulatory milestone in Q1 with conditional approval from Nebraska’s state regulators to establish Telcoin Bank, making it poised to become the first Digital Asset Depository Institution (crypto bank) in the US. This green light positions Telcoin as a bridge between traditional finance and crypto, allowing it to issue fully regulated “Digital Cash” stablecoins and link consumers to DeFi services in a compliant way. Telcoin’s proactive approach to regulation – it even helped draft Nebraska’s digital asset banking law – underscores its growing credibility with policymakers. The company also expanded its global compliance footprint, with licenses or registrations in Singapore, Lithuania, the US, Canada, and Australia, reinforcing TEL Holder confidence in Telcoin’s regulatory-first ethos.

• Product Innovation and User Growth

In February, Telcoin rolled out a major upgrade to its core product with the release of Telcoin Wallet V4.0, a mobile self-custodial wallet update designed as a “gateway to the Internet of Money." The new version introduced an improved user interface and an enhanced “send” flow, enabling users in supported regions to fund remittances directly from their crypto balance. More importantly, Wallet V4 implemented under-the-hood upgrades that lay the groundwork for Telcoin’s upcoming Digital Cash stablecoins and integration with Telcoin Bank. These enhancements – including upcoming bank account linkages, multi-currency stablecoin support, and expanded payout corridors – set the stage for Telcoin’s next growth phase in user adoption.

• Strategic Partnerships and Market Traction

Telcoin accelerated market expansion through high-profile partnerships in Q1. Notably, it partnered with fintech innovator Powerhive to launch the world’s first blockchain-powered platform for financing energy and mobility assets, using Telcoin’s regulated Digital Cash for real-time investment yields. Announced at MWC Barcelona 2025, this partnership leverages Telcoin’s stablecoin infrastructure (including a planned Kenyan shilling eKHS stablecoin) for frictionless payments in emerging markets. Telcoin also teamed up with The Game Company, a Dubai-based cloud gaming pioneer, to integrate Telcoin’s blockchain network and payment rails into a global gaming platform. This collaboration will enable mobile gamers to seamlessly store and transfer winnings in TEL, ETH, or Telcoin’s stablecoins, bringing mobile-first DeFi to the booming cloud gaming sector. These partnerships open new use cases for Telcoin’s technology and demonstrate real-world traction across diverse industries (energy, telecom, and gaming).

• Industry Engagement and Leadership

Telcoin’s leadership raised the company’s profile through active participation in major industry forums during Q1. The team had its largest-ever presence at Mobile World Congress (MWC) 2025 in Barcelona, where Telcoin served as an exhibitor and engaged in high-level discussions with global mobile network operators. CEO Paul Neuner and other executives met with telecom giants (such as Viettel Group) to explore validator partnerships on the Telcoin Network, reflecting strong interest from the telecom industry in Telcoin’s blockchain. Telcoin’s leaders also continued to advocate for forward-thinking fintech policy – for example, Paul Neuner authored an op-ed highlighting how crypto-backed digital cash can revitalize community banks. By sponsoring and speaking at fintech and policy events, Telcoin’s team has been showcasing its global vision and reinforcing its reputation as a compliant innovator in blockchain finance.

Q2 2025 Outlook and Key Catalysts

Looking ahead, Telcoin is entering Q2 2025 with significant catalysts on the horizon. Current and prospective TEL Holders can anticipate several major developments that build on Q1’s momentum

• Telcoin Bank Launch & eUSD Stablecoin

Following regulatory approval, Telcoin expects to launch Telcoin Bank in Q2 – a debut that will introduce eUSD, the first bank-issued US dollar stablecoin fully backed by a regulated institution. The eUSD rollout will serve as the backbone of Telcoin’s broader multi-currency Digital Cashstrategy, enabling low-cost, instant settlements for global users. This launch will also unlock a suite of blockchain-powered banking services (from digital asset accounts to merchant payments), signaling Telcoin’s entry into stablecoin-based remittances and fintech services at scale. Successfully delivering the world’s first regulated crypto bank and stablecoin will be a transformative milestone, expected to bolster Telcoin’s revenue model and industry stature.

• Telcoin Network Mainnet Progress

On the technology front, Telcoin is nearing completion of its blockchain network. A code freeze for the Telcoin Network Alpha Mainnet is scheduled for May 5, 2025, marking the point at which development features are finalized for security auditing. This brings Telcoin closer to launching its public Alpha Mainnet – an Ethereum-compatible network secured by telecom operators – in the coming months (as targeted in 2025). The Alpha Mainnet launch will be followed by a Beta Mainnet by year-end 2025, expanding the network’s capacity and decentralization. This phased rollout of Telcoin’s “Internet of Money” infrastructure will allow GSMA mobile carriers to begin validating transactions and developers to deploy DeFi applications tailored for mobile users. For TEL Holders, the successful go-live of Telcoin’s blockchain will validate years of R&D and potentially unlock new value streams (transaction fees, increased TEL utility as the network’s gas token, etc.).

• Exchange Listings and Liquidity

Telcoin’s recent achievements have sparked speculation about broader exchange support for its native TEL token. The crypto community is buzzing with rumors of a Tier-1 exchange listing – possibly on a major platform like Coinbase or Binance – given Telcoin’s enhanced compliance credentials and growing market demand. While no official listing announcements have been made as of this writing, Telcoin’s progress in securing a regulated bank charter and delivering on its roadmap increases the likelihood of new exchange listings in Q2. Such listings would significantly improve TEL’s liquidity and accessibility, opening the door for a wave of new TEL Holders and higher trading volumes. Greater exchange presence, if realized, will be a positive catalyst for Telcoin’s market traction and token utility (as TEL is used for Telcoin Network fees and DeFi liquidity).

• Global Digital Cash Expansion

Q2 will also see Telcoin pushing its Digital Cash initiative onto the global stage. With eUSD set to launch in the U.S., Telcoin plans to expand into additional fiat-pegged stablecoins to serve key remittance corridors. The company has already signaled interest in markets like East Africa – for instance, establishing operations in Kenya very likely to develop an eKSH (electronic Kenyan shilling) stablecoin – and other regions where mobile money is prevalent. This multi-currency stablecoin strategy will allow Telcoin to natively support digital cash in local currencies, driving financial inclusion by enabling anyone with a mobile phone to send, receive, or save money globally with near-zero friction. By the end of Q2, Telcoin expects to make headway on additional stablecoin launches or partnerships with local institutions, further extending its reach in the $200+ billion global remittance market.

• Mobile-First DeFi Services

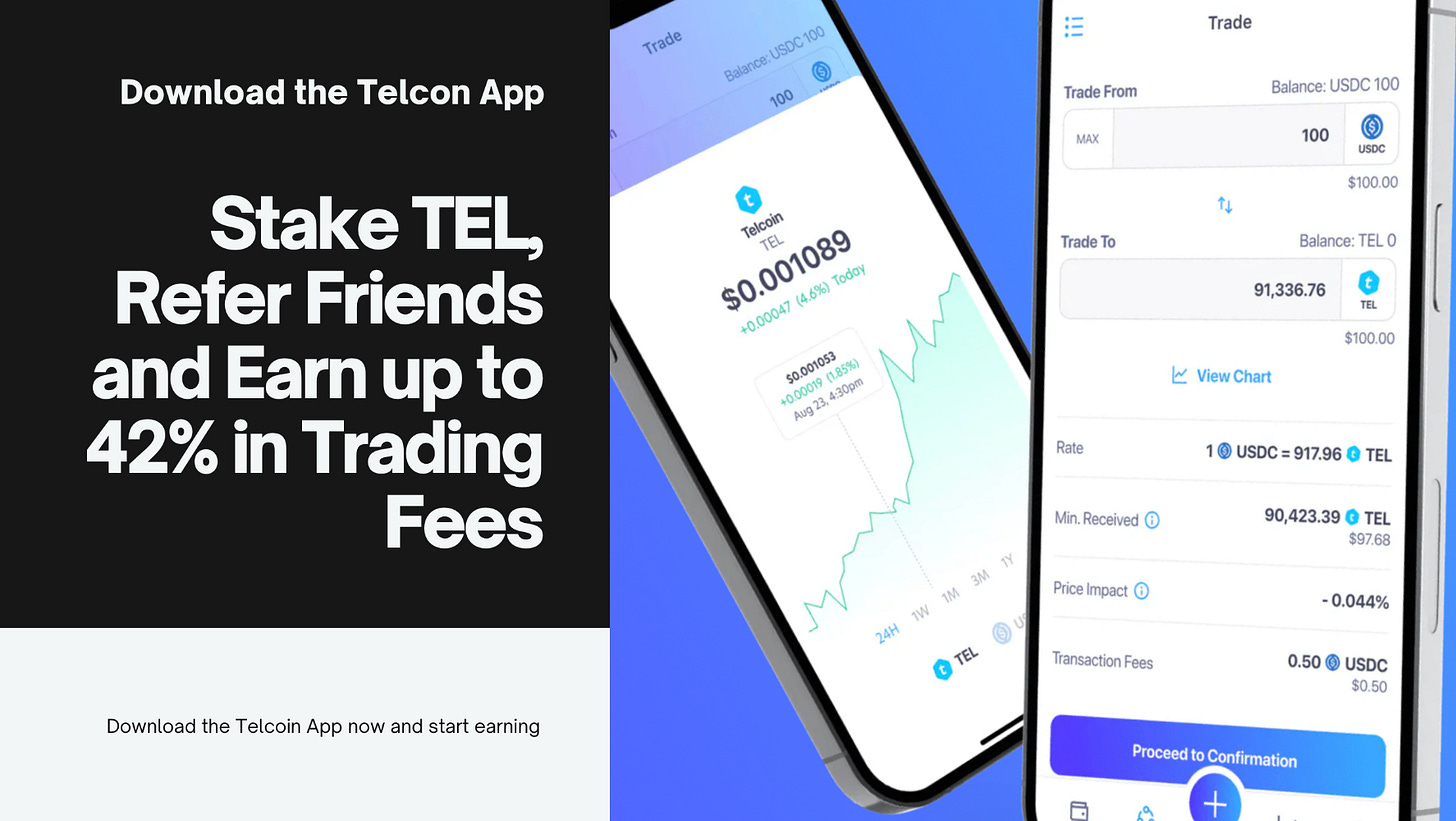

As Telcoin Bank and the Telcoin Network come online, the company is poised to introduce mobile-first DeFi use cases in a regulated context. Telcoin Bank will be uniquely authorized to connect customers to decentralized finance – offering services like on-chain staking, lending, and yield farming within a compliant banking framework. In Q2, Telcoin aims to integrate these DeFi features into the Telcoin app, allowing users to seamlessly earn yield on their assets or borrow against crypto, all through an intuitive mobile interface. By merging the benefits of DeFi with the safeguards of a regulated bank, Telcoin is crafting a user experience that could appeal to mainstream audiences. As the quarter progresses, TEL Holders can look for updates on pilot programs or beta launches of Telcoin’s DeFi-enabled products (for example, interest-bearing stablecoin accounts or Telcoin-powered remittance lending). These innovations highlight Telcoin’s technology leadership and commitment to making decentralized finance accessible to everyday mobile users.

Bottom line

Telcoin’s strong Q1 performance and ambitious Q2 roadmap underscore a company entering an inflection point. The combination of market traction (with real-world partnerships and user growth), technological innovation (proprietary blockchain and digital cash platform), and hard-won regulatory credibility (first-of-its-kind banking charter) is solidifying Telcoin’s position in the fintech arena. Management’s active engagement at industry events and in policy circles has further enhanced Telcoin’s visibility and trust. While challenges always remain in execution, Telcoin’s progress in 2025 so far reflects an optimistic yet realistic growth story – one of a fintech bridging mobile telecom and decentralized finance. Current and prospective TEL Holders can take confidence that Telcoin is delivering on its vision and is well on its way to “building the Internet of Money," with multiple value-driving catalysts on deck in the coming quarter.

Selected sources

1. Fintech Times – Telcoin Bank approval and stablecoin launch

2. Telcoin Official News – Telcoin Wallet V4 release details

3. Business Wire (via Kalkine) – Telcoin & Powerhive partnership at MWC 2025

4. GAM3S.GG News – The Game Company partnership with Telcoin

5. TelcoinFan (X/Twitter) – Telcoin CEO engagements at MWC25

6. Crypto.news – Paul Neuner op-ed on crypto and community banks

7. Altcoin Hero (X/Twitter) – Telcoin Network Alpha Mainnet code freeze May 2025

8. Blockopedia – Telcoin Network roadmap (Alpha/Beta Mainnet timeline)

9. Beehiiv Newsletter – Speculation on Tier-1 exchange listing for TEL

10. Telcoin Press Release – Telcoin’s global licenses and DeFi banking plans

Disclaimer

The information and content (collectively 'information') provided herein are general information. The authors do not guarantee the suitability or potential value of any information or particular investment source. Any information herein is not intended, nor does it constitute financial, tax, legal, investment, or other advice. The authors have no affiliation with Telcoin or other persons or companies referred to in this article. The information in this article is based on the sources used.

thanks for yet another awesome update and newsletter!!