In a notable policy shift, U.S. President Donald Trump recently called on Congress to pass stablecoin legislation—an acknowledgement that stablecoins now play a pivotal role in the financial ecosystem. This regulatory spotlight comes at a time when vulnerabilities in the structure of traditional stablecoins are increasingly apparent.

Paul Neuner, CEO of Telcoin, has echoed these concerns, reflecting on the systemic fragility of stablecoins backed by on-balance sheet deposits. As Neuner observed in 2023, when stablecoin reserves are concentrated in uninsured deposits held within traditional banking infrastructure, users are exposed to liquidity risks during market turbulence. He argued that the “bare metal” solution lies in issuing regulated stablecoins through licensed financial institutions, backed by off-balance sheet reserves and designed for seamless movement across financial systems. Telcoin’s Digital Cash embodies this architectural reimagination—offering a regulated, transparent, and user-centered alternative to traditional models.

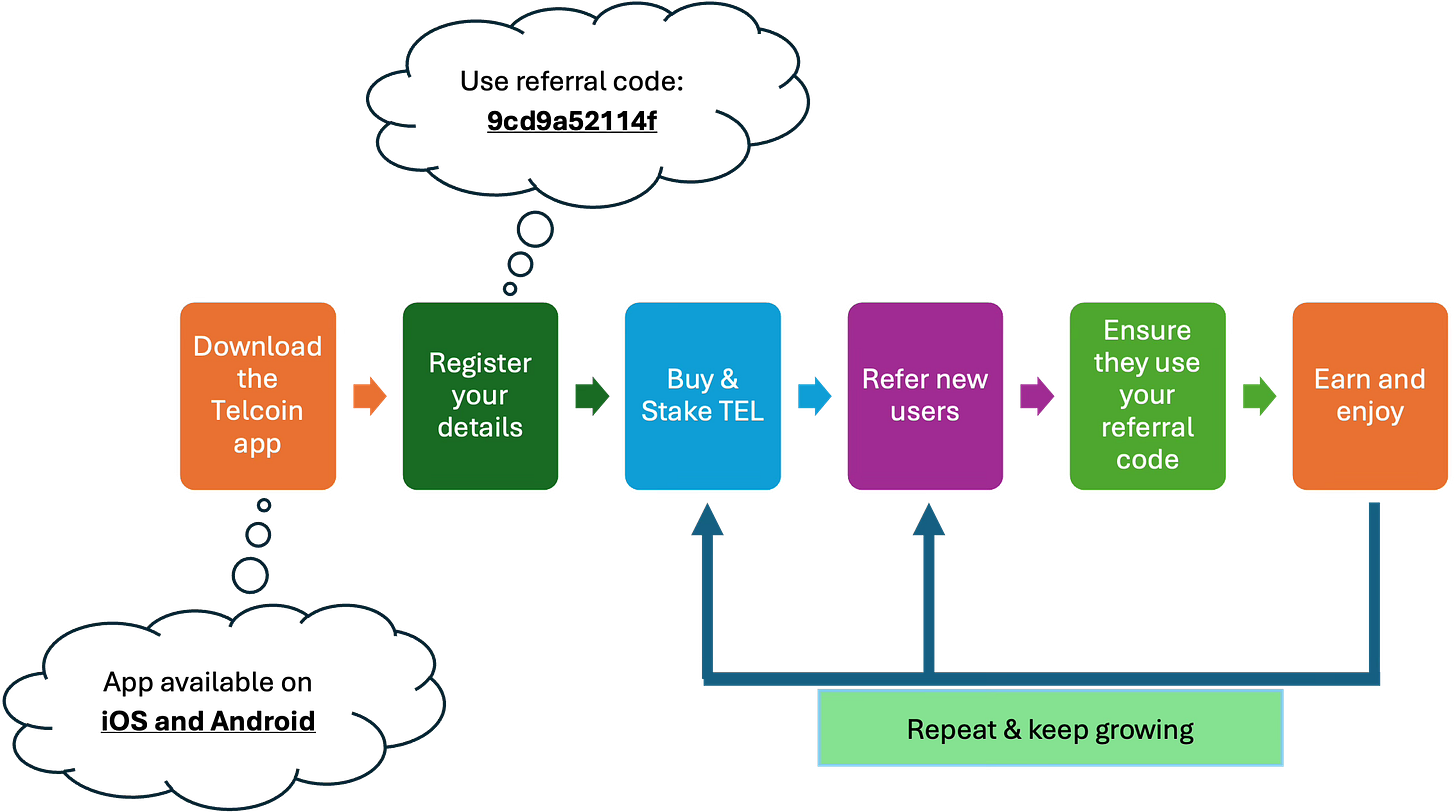

DID YOU KNOW: Telcoin App users participate in Stake & Earn programme where they share up to 3.2 million TEL each week as rewards. Download the Telcoin App here and follow the easy steps to participate

The Structural Limits of Traditional Stablecoins

Traditional stablecoins, pegged to fiat currencies and often issued by private entities, were initially heralded as tools to minimize the volatility of cryptocurrencies. Yet their promise of stability is undermined by significant systemic weaknesses. Chief among these is opaque reserve management. Leading issuers have drawn criticism for failing to conduct or publish regular, independent audits, casting doubt on the reliability of their collateralization claims.

More importantly, many operate within regulatory vacuums, lacking formal oversight or clear jurisdictional anchors. As the recent collapses of banks such as Silvergate and Silicon Valley Bank illustrate, the interdependence of crypto and traditional finance can magnify systemic risk when built on fractional reserve banking models with fragile capital buffers. Traditional stablecoins that rely on uninsured, on-balance sheet bank deposits are thus vulnerable to bank runs and credit contagion—ironically undermining the very stability they are designed to provide.

Telcoin’s Digital Cash: A Purpose-Built Response

Telcoin’s “Digital Cash” represents a decisive shift in both theory and practice. Rather than operating in regulatory liminality, Telcoin has established a licensed banking institution—Telcoin Bank—which has received conditional approval from the Nebraska Department of Banking and Finance. This regulatory legitimacy allows Telcoin to issue digital currencies such as eUSD and eEUR under a framework that enforces compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) standards.

Unlike traditional stablecoins, which depend on discretionary practices of private issuers, Telcoin’s Digital Cash is governed by formal statutory oversight. This structure aligns with emerging global consensus on the need for regulated fiat-backed digital currencies—anticipating rather than reacting to policy evolution. Telcoin’s approach also enhances user trust by implementing monthly attestation reports conducted by external auditors, providing verifiable data on reserve holdings versus circulating supply.

Off-Balance Sheet Reserves and Self-Custody

What fundamentally distinguishes Telcoin’s model is its off-balance sheet architecture. In contrast to stablecoins collateralized by deposits vulnerable to bank capital constraints, Telcoin’s reserves are managed to avoid the pitfalls of fractional reserve exposure. This mitigates risks during periods of market stress and enables 24/7 liquidity without endangering the solvency of partner banks.

Moreover, Telcoin embraces an assisted self-custody model, empowering users to maintain direct control of their digital assets while still accessing traditional financial services. As Neuner noted in 2023, this model not only decentralizes custody but also enables seamless integration with yield-generating instruments such as digital certificates of deposit—without locking consumers into monopolistic banking relationships. This is particularly salient in an era where U.S. savers are offered sub-inflation interest rates by large institutions, despite rising treasury yields.

Inclusion Through Infrastructure

Another critical strength of Telcoin’s model is its emphasis on financial inclusion through mobile-first design. By enabling users—particularly in underbanked regions—to access and use Digital Cash via mobile phones, Telcoin offers a practical solution to the infrastructural barriers that inhibit global financial participation. In markets such as Sub-Saharan Africa, this enables frictionless transactions and savings mechanisms without the need for formal bank accounts.

In this sense, Digital Cash is not only a technological upgrade—it is a socioeconomic tool. It democratizes access to financial services while preserving the liquidity, accessibility, and trust that physical cash represents. It also facilitates direct merchant payments with minimal transaction fees, challenging the entrenched intermediaries of the current payments ecosystem.

A Foundation for the Future of Money

Telcoin’s model reflects a bottom-layer redesign of the monetary system—an architecture that does not merely digitize fiat currency, but reconstructs the underlying infrastructure to support digital-native liquidity. As Neuner argued, this is not a “crypto issue,” but rather a “technology of money” issue. Demand for borderless, round-the-clock capital flows cannot be legislated out of existence; it must be addressed through robust, compliant, and consumer-friendly infrastructure. By issuing stablecoins directly as digital cash within a licensed banking framework, Telcoin offers such a solution.

Bottom line

As policymakers move to regulate stablecoins in earnest, Telcoin’s Digital Cash stands as a forward-compatible alternative that internalizes both the lessons of past failures and the demands of future financial systems. Through regulated issuance, off-balance sheet reserves, transparent auditing, and a user-first design, Telcoin has created a structurally sound and policy-aligned instrument for global value exchange. Where traditional stablecoins falter under the weight of legacy infrastructure and opaque governance, Digital Cash charts a new path—one that is secure, inclusive, and architecturally future-proof.

Disclaimer

The information and content (collectively 'information') provided herein are general information. The authors do not guarantee the suitability or potential value of any information or particular investment source. Any information herein is not intended, nor does it constitute financial, tax, legal, investment, or other advice. The authors have no affiliation with Telcoin or other persons or companies referred to in this article. The information in this article is based on the sources used.