World renowned investors such as Warren Buffett and Charlie Munger have cast doubts on crypto as a legitimate investment strategy. However, leading investors such as Elon Musk and Tim Cook have invested their own finances in crypto. What we are seeing is the clash of generations as Elon Musk and Tim Cook represent 21st century investors while Warren Buffett and Charlie Munger are giants of the 20th century.

Claims by Mr Munger that “cryptocurrency is ‘crazy, stupid gambling,’ and ‘people who oppose my position are idiots’” is probably indicative of a lack of understanding the digital world we live in, and its investment potential.

Understanding Web 3.0, crypto, DeFi, and blockchain technology is not easy; and most people reject these due to lack of understanding, and fear.

Web 3.0, the next generation of the internet, is poised to revolutionize the digital landscape with its decentralized, user-centric, and trustless nature. As the world shifts towards a more open and decentralized internet, cryptocurrencies have emerged as a key component of Web 3.0, offering unique investment opportunities. Having recently launched its services in the EU, Telcoin, a digital financial services provider that leverages blockchain technology to enable fast, low-cost remittances and mobile money transfers, is gaining traction as a promising investment option in the world of Web 3.0.

In this article, we will explore what Web 3.0 is, how to invest in Web 3.0 through holding, providing liquidity, and staking crypto, and why Telcoin presents a compelling investment strategy for Web 3.0 enthusiasts. I am convinced that if Warren Buffett and Charlie Munger understood Web 3.0 and Telcoin they wouldn’t hesitate to download the Telcoin App, hold TEL, provide liquidity, and participate in the Telcoin Stake & Earn program.

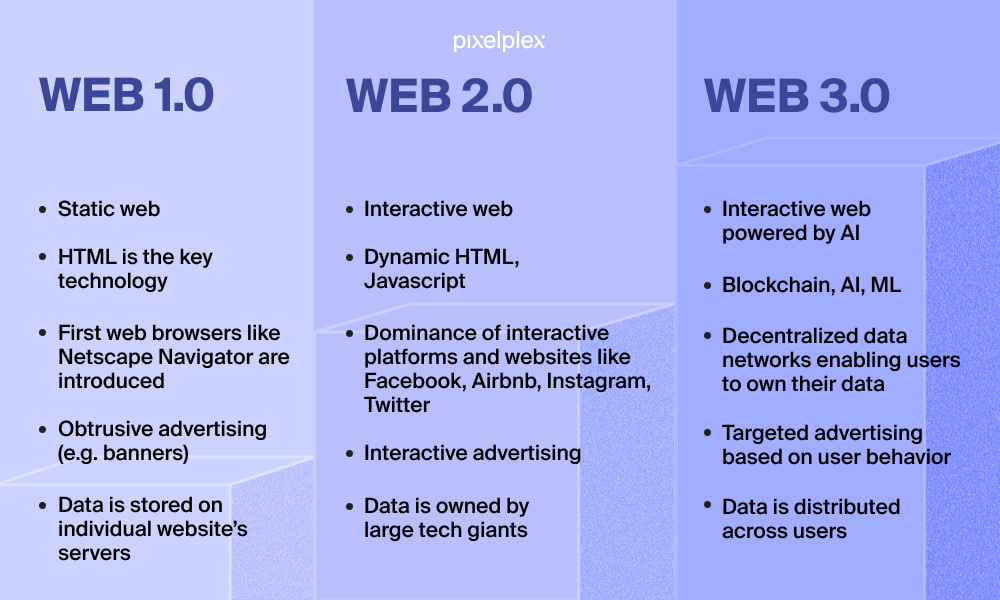

What is Web 3.0?

Web 3.0, also known as the decentralized web, refers to the next generation of the internet that is characterized by increased user privacy, data ownership, and control. Unlike Web 2.0, which relies on centralized platforms that collect and monetize user data, Web 3.0 aims to empower users by giving them ownership and control over their data. This is made possible through blockchain technology, which provides a decentralized, transparent, and immutable ledger that eliminates the need for intermediaries.

Web 3.0 is expected to disrupt traditional industries and enable new business models that leverage decentralized applications (dApps) and cryptocurrencies. As the internet becomes more decentralized, cryptocurrencies are emerging as a fundamental building block of Web 3.0, offering investors unique opportunities to participate in this paradigm shift.

Web 3.0 Economy

The Web 3.0 economy, also known as the decentralized web or the blockchain economy, is still in its early stages but has been rapidly growing in recent years. The Web 3.0 economy encompasses a wide range of decentralized applications (dApps), platforms, protocols, and cryptocurrencies that are built on blockchain technology and aim to disrupt traditional centralized systems.

The exact size of the Web 3.0 economy is difficult to determine due to its dynamic and constantly evolving nature. However, there are several key indicators that highlight the growth and potential of the Web 3.0 economy:

Market Capitalization of Cryptocurrencies: The market capitalization of cryptocurrencies, which are a key component of the Web 3.0 economy, has grown significantly over the past few years. As of April 15 2023, the total market capitalization of cryptocurrencies is just over $1.3 Trillion with trading volume at $42.2 Billion (source: coingecko.com). This demonstrates the substantial value that has been created within the Web 3.0 economy.

Growth of Decentralized Finance (DeFi): DeFi refers to a subset of the Web 3.0 economy that focuses on building financial applications and services on decentralized blockchain platforms. DeFi has experienced tremendous growth in recent years, with billions of dollars locked in various DeFi protocols, including decentralized exchanges (DEXs), lending and borrowing platforms, yield farming, and more. This growth in DeFi showcases the increasing adoption of blockchain technology for financial applications, and the potential disruption of traditional financial systems. As of April 15 2023 DeFi crypto market cap is just over $55 billion with a total trading volume of $2,5 billion (source: coingecko.com).

NFT Market Growth: Non-Fungible Tokens (NFTs) are another significant aspect of the Web 3.0 economy. NFTs are digital assets that represent ownership of unique items, such as digital art, collectibles, and virtual real estate. The NFT market has experienced explosive growth in recent years, with high-profile NFT sales making headlines and attracting mainstream attention. This highlights the potential of NFTs to revolutionize industries such as art, gaming, and virtual real estate, within the Web 3.0 economy.

Increasing Adoption of Blockchain Technology: Beyond cryptocurrencies, DeFi, and NFTs, blockchain technology is being adopted in various sectors and industries beyond finance and art. From supply chain management to healthcare, from gaming to identity verification, blockchain technology is being explored and implemented in diverse ways, showcasing the potential for widespread adoption of the Web 3.0 economy.

Startups and Investments in Web 3.0: There has been a significant influx of startups and investments in the Web 3.0 space in recent years. Venture capital firms, institutional investors, and individual investors have been actively funding and supporting projects and initiatives within the Web 3.0 economy. This indicates the growing interest and recognition of the potential of Web 3.0 as a disruptive force in the technology landscape.

While the Web 3.0 economy is still in its early stages and its exact size is challenging to quantify, the above indicators demonstrate the significant growth and potential of this emerging ecosystem. As more dApps, protocols, and platforms are developed, and as blockchain technology continues to gain adoption in various sectors, the Web 3.0 economy is expected to continue its expansion and reshape the way we interact with the internet and digital assets.

Investing in Web 3.0 through cryptos such as Telcoin

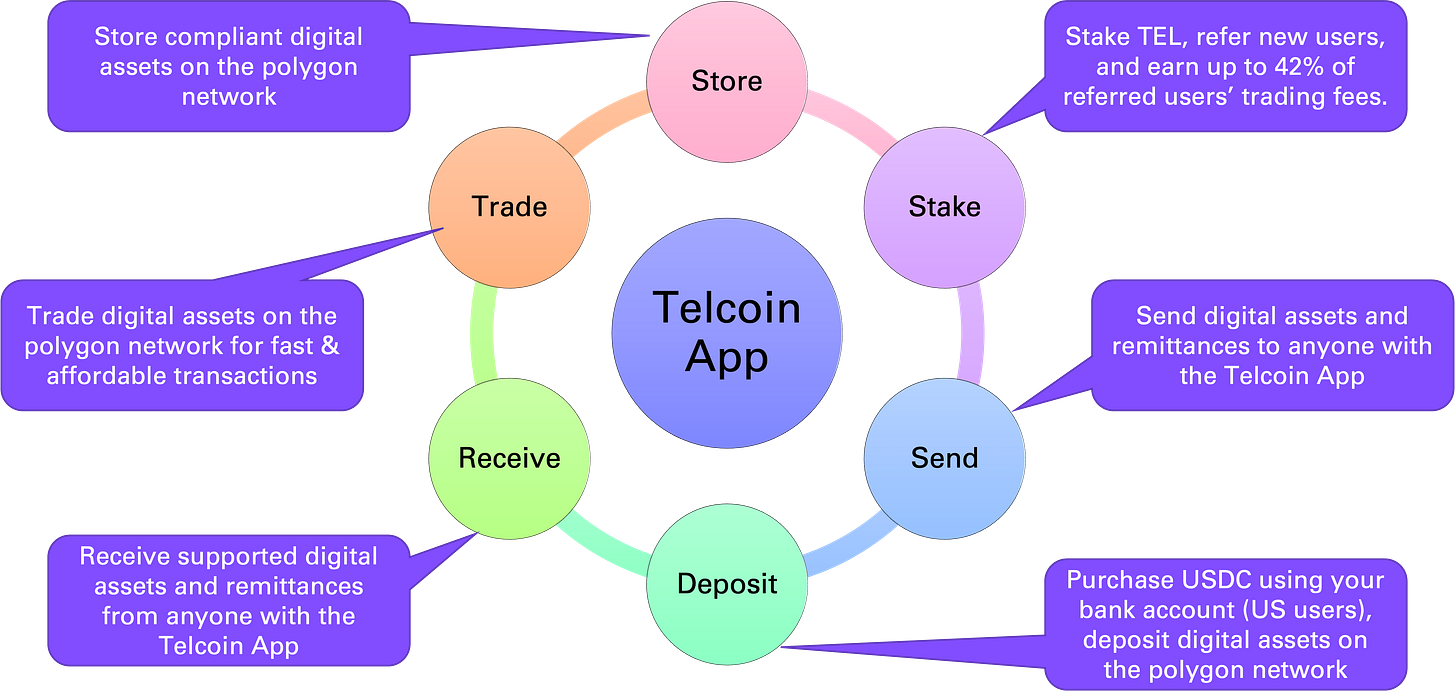

Investing in Web 3.0 can be done through various strategies, including holding cryptocurrencies, providing liquidity on decentralized exchanges (DEXs), and staking crypto. Let's take a closer look at each of these strategies.

Holding cryptocurrencies: Holding cryptocurrencies, such as Telcoin (TEL), is a straightforward way to invest in Web 3.0. By purchasing and holding Telcoin tokens, investors can benefit from potential price appreciation as demand for the token increases due to its utility and adoption in the Web 3.0 ecosystem. As Telcoin gains more traction as a preferred digital currency for remittances and mobile money transfers, its value could potentially increase, offering investors a potential return on their investment. Users can hold they Telcoin on the Telcoin app here, or the Ledger Hardware Wallet available here.

Providing liquidity on DEXs: Decentralized exchanges (DEXs) are a key component of Web 3.0, as they allow users to trade cryptocurrencies in a peer-to-peer manner without the need for intermediaries. By providing liquidity on DEXs, investors can earn fees and rewards for facilitating transactions on the platform. This involves depositing cryptocurrencies, such as Telcoin, into a liquidity pool, which is then used to facilitate trades. In return, investors earn a share of the trading fees and rewards generated by the liquidity pool. Providing liquidity on DEXs can be a lucrative strategy for investors looking to participate in Web 3.0 and earn passive income.

In 2021, Telcoin launched TELx, a decentralized liquidity network powered by active Telcoin users on decentralized financial (DeFi) protocols. It functions as the self-custodial “liquidity engine” of the Telcoin Platform’s user-owned products. The goal of TELx is to offer intuitive and affordable financial services, where user ownership of the network enables any mobile phone user in the world to capture incentives that would typically be awarded to legacy financial institutions. Users can participate in TELx liquidity pools here.

Staking crypto: Staking involves locking up a certain amount of cryptocurrency for a specified period of time to support the operations of a blockchain network. In return, investors earn rewards in the form of additional tokens or fees generated by the network. Staking is a popular investment strategy in Web 3.0 as it allows investors to earn passive income while also contributing to the security and decentralization of the blockchain network.

Telcoin has introduced staking options for its token, allowing investors to stake their Telcoin tokens and earn rewards. Telcoin users can stake the Telcoin (TEL) token on the Telcoin app (available here), refer new users to the app, and earn up to 42% of their referred users’ trading fees. This can be an attractive investment strategy for those who believe in the long-term potential of Telcoin as a digital currency for remittances and mobile money transfers.

Telcoin, with its focus on facilitating fast, low-cost remittances and mobile money transfers, has gained significant attention as a promising digital currency for the Web 3.0 era. Telcoin presents a compelling investment strategy for Web 3.0 enthusiasts and investors looking to participate in the decentralized, user-centric, and trustless future of the internet. By holding, providing liquidity, and staking Telcoin, investors can potentially benefit from its strong utility and adoption, revenue-sharing programs, growing ecosystem, community governance, and early-stage investment opportunity. Telcoin has also adopted a compliance-first strategy which embraces regulations. This way, Telcoin works with regulators to develop regulatory frameworks, and ensure that its users are protected.

Bottom line

In conclusion, Web 3.0 represents the next frontier in the evolution of the internet, and investing in this space can offer exciting opportunities for crypto enthusiasts and investors. The Web 3.0 economy, characterized by decentralized applications, blockchain technology, and innovative use cases like DeFi and NFTs, has been rapidly growing and disrupting traditional systems. Holding, providing liquidity, and staking Telcoin can be a compelling investment strategy within the Web 3.0 economy, as Telcoin aims to revolutionize the telecommunications industry through its blockchain-based remittance and financial services.

As with any investment, it's important to conduct thorough research, understand the risks involved, and consider your own financial goals and risk tolerance. However, with the potential for significant growth and disruption, Web 3.0 and Telcoin present intriguing investment opportunities for those interested in the future of technology and finance. Stay informed, explore the possibilities, and consider the potential of Web 3.0 and Telcoin in your investment portfolio.

DID YOU KNOW?

Users in the Lithuania and the US can cash in to USDC from their bank account, enabling low-cost trades into assets available of the Telcoin App. This facility is coming to users around the world soon!!! Download the Telcoin App now, and benefit from the upcoming influx of users as Telcoin expands around the world

Disclaimer

The information and content (collectively 'information') provided herein are general information. The authors do not guarantee the suitability or potential value of any information or particular investment source. Any information herein is not intended, nor does it constitute financial, tax, legal, investment, or other advice. The authors have no affiliation with Telcoin or other persons or companies referred to in this article. The information in this article is based on the sources used.

Great work as always!!!